Learn what it means to have a FICO of 486. Understand how it's calculated, what loans you can obtain, and how to better your FICO score

A credit score is needed for you to be able to get a loan or credit. The reason behind this is because it will help financial institutions to determine your creditworthiness. They will also see every loan that you made and the payment history that you have. Find out more about it by reading the information below.

Credit scores are calculated based on the proprietary algorithm. This will include the person's outstanding debts, payment history, and the length of the individual's credit history.

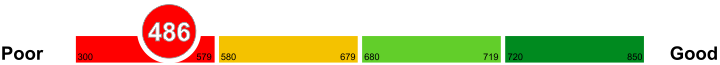

Credit scores can range from 300 to 850. The higher the individual's score, the lower the risk. People who have lower credit scores are considered high risk, which will make lending companies ask for more requirements.

About Fico scores

Fair Isaac Corporation is the one who established FICO, and it is one of the most commonly used credit scoring systems today.

According to FICO, 90% of the most reputable and respected lenders today are making decisions according to this kind of credit scoring system. Get to know more about Fico scores by reading the information below.

How FICO is calculated

Different grade scales are used around the world, but the most commonly used system is the FICO score. FICO stands for Fair Isaac Corporation, which is responsible for calculating your FICO score.

FICO has not declared any detailed explanation on how the FICO score is calculated. However, some of the important variables considered in determining your credit score are as follows:

First and foremost, your payments are considered in calculating your FICO score. It comprises for almost 35 % of your FICO score. Next, 30 % of the score is calculated by your debts. Your length of credits accounts for next 15 %, followed by the type of credit used and some inquiries made for credit hold 10 % value each in FICO scores.

Explanation of FICO ranges

If you are wondering about the explanation of FICO ranges, then reading the information below will help.

Having knowledge about the credit score is essential as this can give a huge impact on your future. Knowing your credit score will help you know the credit worthiness that you have. Here are the explanation of FICO ranges.

579 and Below

579 and below means you have a poor FICO. Lenders may require a certain amount of deposit before granting your application.

670 to 739

670 to 739 is a good FICO; wherein borrowers are considered as acceptable.

740 to 799

740 to 799 is a very good FICO; wherein borrowers can expect better interest rates.

800 and Above

800 and above is an exceptional FICO and people with this score are quickly approved of their application.

What does it mean to have a FICO of 486

With a FICO score of 486, you would need to understand better the things that are keeping your scores low. The main suspects of the things that are keeping your scores low may include the history of your collection accounts, unsatisfied judgment, derogatory remarks of bankruptcy, a foreclosure, high level of credit utilization, late loan or bill repayment time or a combination of the above things. A student loan repayment is often not mentioned, but it also affects your credit score rating and your general credit health.

Improving your FICO score beyond 486

The best way to improve your credit score past 486 is to consider trying to challenge all the possible negative items on your credit report. You need to eliminate all the flimsiest arguments that can negatively affect your credit rating. Some people will go to the extent of engineering the bill repayment modes. They will put their fixed bills such as phone bills on automatic monthly electronic payments. Keeping your bill balances on a low note is the best way to get a positive credit rating. You also need to monitor your bills and keep your financial history healthy.

Keeping an eye on errors

Remember that even financial errors keep an eye on financial history. The errors are random, and they will occur even if you've done nothing wrong. When the errors occur, do not wait until your creditors point out the errors. Instead work hard to follow and correct these errors that emanate from various sources. Update your credit information and keep it current.

Credit cards with a FICO of 486

If you are applying for a credit card with a FICO of 486, you should expect that it won't be easy.

A FICO of 486 is known as a poor score, which is why doing things that can help you improve your score is ideal. Once you have improved your score, it would be best to keep it that way to make it easier for you to get a credit card whenever you need one.

Paying Your Balances Off

It would be best to pay off every balance that you have. Your balance on your credit card should be paid off in full or at least below 30% of your total limit.

Increasing Limit

It would also be best to as the card company to increase your limit. The reason behind this is because it can lower the ratio of credit utilization, thus improving your FICO.

Car loans with a FICO of 486

Are you wondering if it is possible to get car loans with a FICO of 486? Then let's find out how you can get the loan that you need for your vehicle.

Financing companies require their clients to have at least a fair score before they grant them the loan that they need. The reason behind this is because people with decent scores are not considered as high-risks for their companies. If you are planning to get a car loan with a FICO of 486, then reading some of the tips below is essential.

Higher Interest Rates

Financing companies may lend you a loan with a FICO of 486, but they will surely be giving you a higher interest rate. For instance, a loan for a USD 12,000 with an interest rate of 24%. But you can negotiate with them to lower their price more for you.

Proof of Income

Provide financing companies with all the proof of income that you can show them. You can give them your annual tax return, bank statement, and such. The reason behind this is because it will help you increase your chances of getting the loan that you need.

Mortgages with a FICO of 486

With a FICO score of 486, you might not be having too many options to finance your home loan or mortgage needs. You might get your loan request rejected by well-renowned banks and other lending institution. A FICO score of 486 is considered bad, and a high of default is associated with the client by the lending institution.

You can try the local or small-scale banks in your area. They might be willing to lend you credit for a home loan or mortgage.

You can also explore the option of getting credit or loan from a credit union. A credit union is a not for profit organization. Therefore, you may be able to get a loan from a credit union at very low-interest rates.

Home Loans with a FICO of 486

If you have a FICO score of 486, it shows a bad credit history. Most of the top banks will reject your loan request. Therefore, you will have to look around for other options that you might have with such a low FICO score.

You can get a house through seller financing. It only happens when sellers' mortgage is entirely paid off, or it could be paid with the initial down payment.

If you expect that your credit position is going to improve shortly, you can ask one of your family member who has better FICO score to co-sign for you. This way, you can convince the bank or financial institution to lend you for a home loan. This process will get you a home and in the meantime, you can work on improving your state of FICO score.

Personal Loans with a FICO of 486

You still face harsh loan terms with a FICO score of 486 when looking for a personal loan. Therefore, it is necessary for you to analyze all the possible avenues before settling on one. Different lenders provide different interest rates and loan terms. A comprehensive comparison can help you in picking the friendliest personal loan.

Online micro-lenders

Over the last few years, several online platforms providing personal loans have been set up. They usually have user-friendly interfaces that enable you to apply for a loan with minimal assistance. They loan amounts offered are variable with some going up to $50,000. The repayment periods are equally variable and can last up to five years.

Guaranteed loans

You can find some people to be your guarantors for the personal loan you are taking. The guarantors assume the responsibility of servicing the loan once you are unable to repay it. However, ensure that you take an amount that you can manage without jeopardizing the FICO score of your guarantors.

Payday loans

This avenue can only secure you a small amount over a short period. The interest is potentially higher. You get to pay it with your next salary.

Things you can do to improve your FICO of 486

Improving your FICO score of 486 isn't going to be a simple task unless you embrace good financial practices. You have to come up with a workable plan that assists you in managing your credit well, and you must adhere to it. Improving your FICO score is not a one-time event, but a culmination of several financial actions. It is because the credit rating of an individual depends on the present and past credit-related behavior.

Pay off credit card balances

The credit cards in your possession that have accumulated balances are considered when calculating your FICO score. Therefore, fir you to increase your rating it is necessary to pay off the balances on your credit card, however, small they are. Technically, the trick to improving your FICO score is cutting down your debt.

Monitor your credit utilization ratio

Credit bureaus consider the amount of credit you are using versus the amount of revolving credit available to you. It would be helpful to you to keep the ratio between 30%. You need to pay your credit balances on a regular basis. Closing credit accounts without paying them off increase the ratio thus damaging your score.

Have old debt included in your report

When your FICO score is being determined, your credit history comes into play. Contrary to beliefs, old debt doesn't necessarily damage your score unless it is bad credit. Keep in mind that bad debt gets removed from your report within seven years. Old debt contributes to the health of your credit history.