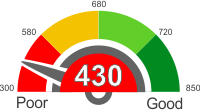

Learn what home loans you can get with a credit score of 430 and understant the things you can do to better your credit score.

A credit score is needed for you to be able to get a loan or credit. The reason behind this is because it will help financial institutions to determine your creditworthiness. They will also see every loan that you made and the payment history that you have. Find out more about it by reading the information below.

Credit scores are calculated based on the proprietary algorithm. This will include the person's outstanding debts, payment history, and the length of the individual's credit history.

Credit scores can range from 300 to 850. The higher the individual's score, the lower the risk. People who have lower credit scores are considered high risk, which will make lending companies ask for more requirements.

Home loans with a credit score of 430

If you are planning to apply for home loans with a credit score of 430, then increasing your chances of getting approve is essential.

A credit score of 430 is known as a poor score, which is why people with this rating usually end up getting declined. The good news is, there are some things that you can do to increase your chances of getting that home loan.

Add Down Payment

Providing the lender a down payment is essential as this means that they no longer need to let you borrow a higher amount of loan. Giving them a down payment will also provide an impression that you can pay them off.

Co-Signee

It would also be better to ask for a family member to co-sign with you. Lenders will feel more at ease that you have a co-signee. Just make sure that the person has a higher credit score than you.

About Fico scores

Fair Isaac Corporation is the one who established FICO, and it is one of the most commonly used credit scoring systems today.

According to FICO, 90% of the most reputable and respected lenders today are making decisions according to this kind of credit scoring system. Get to know more about Fico scores by reading the information below.

How are credit scores calculated?

The weight of each of the five categories are; 30% of amount owned, 10% is for the new credit, 15% accounts for the length of credit history, 10% is the credit mix and the last 35% accounts for the person's payment history.

The FICO score takes into consideration positive as well as negative aspects of the credit report. The percentage or the weight of any of the categories mentioned above may differ from a person to another depending upon the information available in the credit report.

The FICO score takes all of the information from your credit report. However, the banks or any other lending institution might look at your income, type of credit and employment history when you apply for a loan or mortgage.

Once a certain lender asks for a client's credit report, they can also ask for the Fico score. Other sources say that your Fico score will include 35% of your payment history, 30% of your credit utilization, and 15% as to how long have you been borrowing.

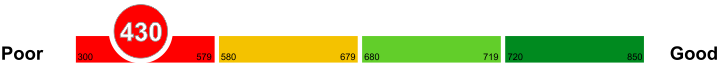

Explanation of credit score ranges

It is important to know the category that you fall into when it comes to credit score for you to be aware. The range of a credit score can go from 300 to 850. Always remember that the higher your score, the higher the chances of you to qualify for a loan. There will also be instances where a financing company is okay with 650 scores, while the other is fine with a 750 score. It will all depend on the lender itself.

A lender or a bank will check your credit score if you qualify for the application that you are requesting. Here are some of the credit score ranges that you should know.

Bad credit score

People with a credit score below 579 is known as high risks. Foreclosures, poor payment history, and bankruptcies are the reasons why people fall into this category.

Good credit score

A good credit score ranges from 680 to 719. People with this credit score can expect approvals and interest rates that are better.

Very Good

A very good credit score ranges from 720 to 799. People with this credit score is known to be small risks, and they often get loan amounts that are higher than usual.

Excellent

An excellent score ranges from 800 and above. Financial freedom is expected to people with this score.

What does it mean to have a credit score of 430

If you are wondering how a credit score of 430 rates then knows that it is a bad credit score. However, with financial health, there is always hope that you can get your bad credit score of 430 to above 590. The best way to try and out the positive way of building your credit score is identifying where you went wrong and know you have bad credit.

Why your score remains at 430

There are approximately four things that hurt a credit score. These risk factors include; too many collections in your credit history report, too many late payments, a high a high number of your financial accounts are closed with open balances and unhealthy public records. Public records such as disciplinary cases also affect your credit report. The records also include; civil judgment, bankruptcy status, child support and tax aliens. Therefore, too much financial indiscipline will affect credit report and hence unhealthy credit score that will put your credit to below 430.

Why you need to improve your 430 credit score

Many things affect your credit score. You should be aware of the financial activities that can affect your credit score and start working up the ladder to improve the same. It takes too long to build a positive credit score, but you need to do this as early as you can. Financial literacy is the resource you use to use to work on a positive credit report. Before you reach a point of wondering how you will deal with bad credit. It is possible to safeguard against a bad credit score through rectifying your collection history, evaluating and working on repairing your credit reports, developing a positive public record that not cause lenders to use it as an excuse for denying you a loan.

Things you can do to improve your credit score of 430

It takes a long time to improve your credit score especially if you a regular loan user. You need to be consistent in the measures you to take to improve it. It is because a credit score takes into account both the previous behavior of the debtor, as well as their present practices. As such, it takes a while to negate the past undesirable credit practices.

Get rid of credit card balances

You can do this by eliminating unnecessary balances, which are the small balances that accumulate on your credit cards. It is because when determining your credit score, the number of credit scores you own that have balances are considered. Collect your credit cards and pay off their balances.

Monitor your credit card balance

Your credit score puts into consideration the amount of revolving credit you have against the amount you are using. It is an advantage to your rating if the percentage is lower with 30% or lower being the optimum. Pay your credit card balances regularly.

Include old debt in your report

Old debt isn't necessarily bad for your rating. It is not a good idea to instruct your credit bureau to delete old debt items especially if they were paid off efficiently. Bad debt usually gets off your report after seven years.