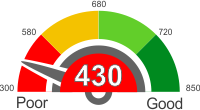

Understand the meaning of having a credit score above 430, how it's calculated, what loans you can get, and how to improve your score

A credit score is needed for you to be able to get a loan or credit. The reason behind this is because it will help financial institutions to determine your creditworthiness. They will also see every loan that you made and the payment history that you have. Find out more about it by reading the information below.

Credit scores are calculated based on the proprietary algorithm. This will include the person's outstanding debts, payment history, and the length of the individual's credit history.

Credit scores can range from 300 to 850. The higher the individual's score, the lower the risk. People who have lower credit scores are considered high risk, which will make lending companies ask for more requirements.

About Fico scores

Fair Isaac Corporation is the one who established FICO, and it is one of the most commonly used credit scoring systems today.

According to FICO, 90% of the most reputable and respected lenders today are making decisions according to this kind of credit scoring system. Get to know more about Fico scores by reading the information below.

How are credit scores calculated?

The weight of each of the five categories are; 30% of amount owned, 10% is for the new credit, 15% accounts for the length of credit history, 10% is the credit mix and the last 35% accounts for the person's payment history.

The FICO score takes into consideration positive as well as negative aspects of the credit report. The percentage or the weight of any of the categories mentioned above may differ from a person to another depending upon the information available in the credit report.

The FICO score takes all of the information from your credit report. However, the banks or any other lending institution might look at your income, type of credit and employment history when you apply for a loan or mortgage.

Once a certain lender asks for a client's credit report, they can also ask for the Fico score. Other sources say that your Fico score will include 35% of your payment history, 30% of your credit utilization, and 15% as to how long have you been borrowing.

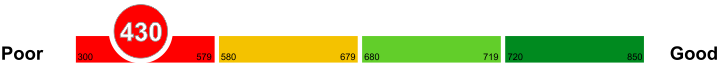

Explanation of credit score ranges

It is important to know the category that you fall into when it comes to credit score for you to be aware. The range of a credit score can go from 300 to 850. Always remember that the higher your score, the higher the chances of you to qualify for a loan. There will also be instances where a financing company is okay with 650 scores, while the other is fine with a 750 score. It will all depend on the lender itself.

A lender or a bank will check your credit score if you qualify for the application that you are requesting. Here are some of the credit score ranges that you should know.

Bad credit score

People with a credit score below 579 is known as high risks. Foreclosures, poor payment history, and bankruptcies are the reasons why people fall into this category.

Good credit score

A good credit score ranges from 680 to 719. People with this credit score can expect approvals and interest rates that are better.

Very Good

A very good credit score ranges from 720 to 799. People with this credit score is known to be small risks, and they often get loan amounts that are higher than usual.

Excellent

An excellent score ranges from 800 and above. Financial freedom is expected to people with this score.

What does it mean to have a credit score over 430

Find out what does it mean to have a credit score over 430 but under 450 by reading the information below.

Sometimes there are things that we do that create an impact on our credit scores. These effects are mostly negative, especially if your credit score is over 430 but under 450. Knowing what the negative effects first is essential for you to avoid them the next time.

Credit History Length

If you have a credit history that is long, then the chances of you having a good credit score is high. But for people with a short history, this can cause problems, as there is little information on where to base their credit scores.

Kinds of Credits

The kind of credits that you have can affect your credit score. Some of the credits that you can have are the mortgages, auto loans, retail accounts, and as well as your credit cards.

Credit cards with a credit score over 430

Credit cards with a credit score over 430 but under 450 usually have lower limits. But requesting for an increase can be done, since it comes with different advantages.

Some people with a credit score over 430 but under 450 are too hesitant to ask for a credit limit increase. But some card companies are giving raises to people with a poor credit score. If you are having second thoughts of asking for one, then knowing the benefits of having a higher credit limit is essential.

Enhanced credit score

Asking for an increase will also increase the available credit that you have on your card. The reason behind this is because it can help lower the ratio of credit utilization, which is a good thing to enhance credit score.

Increased Limits

Since your credit score can improve, this will make most card companies to provide you with credit cards that have higher limits in the future.

Car loans with a credit score over 430

For people who are getting car loans with a credit score over 430 but under 450, it is always best to shop around before signing any deal.

Some companies may say that a credit score over 430 but under 450 are a low score, but some may disagree. Some companies won't mind your score that much, for as long as you can prove that you can pay them off.

20% Down Payment

When getting a loan with an average credit score, it would be best to show the company that you can pay them off. The best way to show this is by giving them a down payment of at least 20% of the total amount that you are borrowing.

Shorter Terms

If a company gave you a high-interest rate, you could propose to lower it down by asking for a shorter term to pay off the loan. But expect to pay higher monthly payments if you choose a shorter one. Also, make sure that the time is ideal to the budget that you have monthly.

Mortgages with a credit score over 430

With a credit score that is above 430 and below 450, you will find it difficult to get loans or credit for your mortgage purposes. Therefore, you will have to look for a different approach. You should start with small scale and local banks and financial institutions. The chances of lending you money or credit for a mortgage is higher compared to other banks.

You can also ask for a close friend or a family member to co-sign for you. If you can get someone with a higher credit score to co-sign for you, it will help your mortgage or loan request. If that doesn't work out for you, you may try to ask them to borrow money for you.

Home Loans with a credit score over 430

Even with a score that is lying in this small category, you can look for several options to get the loan you need. First, you can apply for the government loans for home and mortgage, for example, FHA loans approved in America. Such loans are available at the low cost of borrowings and with easier terms and conditions.

A 30-year mortgage is also considered a good option with a low credit score. You can also opt for an adjustable rate mortgage in which you may be paying less interest rate than the fixed amount interest rates.

Getting a co-signer can open many opportunities for you. It may help in getting your loan approved from banks and other financial institutions.

Personal Loans with a credit score over 430

It is tough for one to get a personal loan with low-interest rates when their credit score is low. Very few banks would be willing to partner with you in your financial development. It calls for an intensive search for alternative sources for your financial needs.

Installment loans

This loan allows you to make equal repayments periodically within loan term that is predetermined. You don't need collateral to be issued with this type of loan. A relatively low-interest rate is offered to you.

Cash advance

Some credit cards can allow you to use their cash advance facility when you are in dire need of financial help. However, if you are employed, you can consider asking for advance payment of your salary from your employer. It is a short-term financing option for your needs.

Payday loans

This type of loan is repaid through a direct debit from your salary on the next day of payment. It is only available to individuals who are employed and have a steady income. Interest rates are higher when compared to installment loans.

Things you can do to improve your credit score of 430

It takes a long time to improve your credit score especially if you a regular loan user. You need to be consistent in the measures you to take to improve it. It is because a credit score takes into account both the previous behavior of the debtor, as well as their present practices. As such, it takes a while to negate the past undesirable credit practices.

Get rid of credit card balances

You can do this by eliminating unnecessary balances, which are the small balances that accumulate on your credit cards. It is because when determining your credit score, the number of credit scores you own that have balances are considered. Collect your credit cards and pay off their balances.

Monitor your credit card balance

Your credit score puts into consideration the amount of revolving credit you have against the amount you are using. It is an advantage to your rating if the percentage is lower with 30% or lower being the optimum. Pay your credit card balances regularly.

Include old debt in your report

Old debt isn't necessarily bad for your rating. It is not a good idea to instruct your credit bureau to delete old debt items especially if they were paid off efficiently. Bad debt usually gets off your report after seven years.