Discover what it means to have a credit score below 618, how it's calculated, what loans you can get, and how to improve your credit score

A credit score is needed for you to be able to get a loan or credit. The reason behind this is because it will help financial institutions to determine your creditworthiness. They will also see every loan that you made and the payment history that you have. Find out more about it by reading the information below.

Credit scores are calculated based on the proprietary algorithm. This will include the person's outstanding debts, payment history, and the length of the individual's credit history.

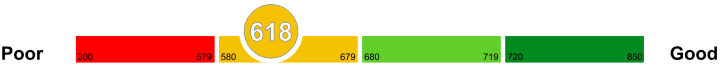

Credit scores can range from 300 to 850. The higher the individual's score, the lower the risk. People who have lower credit scores are considered high risk, which will make lending companies ask for more requirements.

About Fico scores

Fair Isaac Corporation is the one who established FICO, and it is one of the most commonly used credit scoring systems today.

According to FICO, 90% of the most reputable and respected lenders today are making decisions according to this kind of credit scoring system. Get to know more about Fico scores by reading the information below.

How are credit scores calculated?

The weight of each of the five categories are; 30% of amount owned, 10% is for the new credit, 15% accounts for the length of credit history, 10% is the credit mix and the last 35% accounts for the person's payment history.

The FICO score takes into consideration positive as well as negative aspects of the credit report. The percentage or the weight of any of the categories mentioned above may differ from a person to another depending upon the information available in the credit report.

The FICO score takes all of the information from your credit report. However, the banks or any other lending institution might look at your income, type of credit and employment history when you apply for a loan or mortgage.

Once a certain lender asks for a client's credit report, they can also ask for the Fico score. Other sources say that your Fico score will include 35% of your payment history, 30% of your credit utilization, and 15% as to how long have you been borrowing.

Explanation of credit score ranges

It is important to know the category that you fall into when it comes to credit score for you to be aware. The range of a credit score can go from 300 to 850. Always remember that the higher your score, the higher the chances of you to qualify for a loan. There will also be instances where a financing company is okay with 650 scores, while the other is fine with a 750 score. It will all depend on the lender itself.

A lender or a bank will check your credit score if you qualify for the application that you are requesting. Here are some of the credit score ranges that you should know.

Bad credit score

People with a credit score below 579 is known as high risks. Foreclosures, poor payment history, and bankruptcies are the reasons why people fall into this category.

Good credit score

A good credit score ranges from 680 to 719. People with this credit score can expect approvals and interest rates that are better.

Very Good

A very good credit score ranges from 720 to 799. People with this credit score is known to be small risks, and they often get loan amounts that are higher than usual.

Excellent

An excellent score ranges from 800 and above. Financial freedom is expected to people with this score.

What does it mean to have a credit score under 618

Higher your credit score, greater are you chances to acquire loans, credit from the banks and other financial lending institutions. The credit score shows how you have managed your loans and debt in the past and whether you will be able to pay back your loans and debts on time or not.

The credit score that is under 618 but above 550, falls in the average category on the grade scale. Most of the banks in your region will be willing to lend you credit. However, you should look for the one that associates lowest cost of debt to your loan.

Credit cards with a credit score under 618

People with a credit score under 618 but over 550 may not qualify for a credit card.

Most banks see individuals with a low credit score as high risk, which is why they often decline their credit card applications. The good news is, not all banks are like this. There are still a few that will grant you the card that you need.

Marathon Credit Card

Marathon Credit Card offers an interest rate of 16.99% to 24.99% depending on the credit score that you have. They offer a 25 cents a gallon rebate when you spend USD 1,000 in one month. They don't have any annual fee.

USAA Secured Credit Card

USAA has a low interest rate of 9.9% and an annual fee of USD 35. The credit limit will depend on the amount that you are going to deposit. It can range from USD 250 - USD 5,000.

Car loans with a credit score under 618

Car loans with a credit score under 618 but over 550 can be easier to obtain since this score is known as a fair one.

Financing companies today prefer people who have fair to excellent credit score because they know that these people won't have a hard time paying off their loans. For individuals with a credit score under 618 but over 550, getting a loan approve won't be much of a problem since they will probably get accepted. But not all companies are very considerate, which is why knowing some of the things that you can do is important.

Provide a Savings History

If you have a savings account, it would be best to ask your bank for a statement to prove that you have the capacity to pay off the loan that you are requesting. It doesn't have to be big, what matters is that you have funds in the bank.

Choosing the Right Car

Another thing that you can do is to make sure that the car that you are choosing is something that you can afford. Choosing an affordable car also ensures that you won't need a larger amount of loan.

Mortgages with a credit score under 618

With this credit score, you can most probably get the approval for your government loan options such as FHA in the United States. With this credit score, you can also check with the mid-tier banks as some of them would be willing to lend you credit for your home loan or mortgage.

You can also go to Credit Unions which are not for profit organizations. You have to become a member of a credit union, and they can lend you money to cover your financial needs.

However, if the required amount is not very large, you can get yourself a credit card. You can borrow through your credit to pay for mortgage or home loan. The credit card companies pay little attention to your credit score. But, their interest rates need to be checked before time.

Home Loans with a credit score under 618

You have some options to get home loans. You can start with your local banks or some of the major banks that are willing to lend with your given credit score.

However, if you feel that the terms and conditions that are set by the banks are not feasible, you can go the government sponsored loan plans. You might be able to get loans from Federal Housing Administration's approved lenders.

Another good option will be to go to credit unions. They will require you to become a member. Their terms and conditions are relatively easier to manage. Your last option should be to go for the credit card companies.

Personal Loans with a credit score under 618

Personal loans have turned out to be the most efficient solution for financially difficult times. It keeps you going when you fall short of your financial projections. Most people are eligible for credit from various financial institutions, though on different terms and amounts. A credit score is utilized in determining the amount you can be given and the interest rate.

Peer to peer loan

You can take advantage of the numerous online-based lending services to get a personal loan. They offer somewhat competitive rates based on your credit score. Personal loans can be approved instantly or within two days. Amounts up to $35,000 are provided.

Payday loan

If you are employed and have a steady income, you can go for this option. It enables you to repay the loan in bulk on your next payday. The loan amount offered is equivalent to your monthly salary or slightly less. With this personal, you hardly feel the financial pinch of taking humongous loan amounts.

Family and friends

It could be easy for you to get a quick loan from your relatives and friends if you explain to them the necessity of having it. The bureaucracies experienced from formal lenders are almost non-existent while the terms of the loan are flexible and friendly to both parties.

Things you can do to improve your credit score of 618

Good credit will secure your access to cheap credit with better rates and flexible repayment terms. Bad credit shouldn't stop you from obtaining these loans since you can work on improving it. Lenders always give borrowers with good credit a priority when issuing loans hence the need to work on improving it.

Pay credit and other bills on time

Your payment history accounts for about thirty-five percent of your credit score. You should, therefore, ensure you pay your loan on time. You can improve your rating by paying the minimum premium set for each month promptly.

Monitor your credit report

You can request a free credit report from various agencies every four months via AnnualCreditReport.com. When potential lenders do a hard pull of your credit report, your credit score gets slightly damaged. However, you are not penalized if you check it by yourself.

Avoid multiple credit cards simultaneously

A hard pull is conducted on your credit score when applying for a credit card. You should avoid holding multiple credit cards since this translates to several hard pulls that lower your credit score.