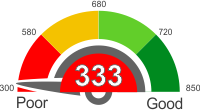

Find out what boat loans are available with a 333 credit score. Learn the things you can do to get a low interest loan and discover how to improve your credit score of 333

Your credit score is what largely determines whether you get credit or not and if the interest rates offered to you will be high or low. A credit score is a number that is calculated from the information contained in your credit report using a mathematical algorithm. The resulting number has three digits and ranges from 300 to 850.The information in the credit report is collected from the credit bureaus Transunion, Experian, and Equifax.

The credit scoring system was introduced in 1989 by Fair, Isaac, and Company, currently known as FICO. Since then, the FICO model has been adopted by a majority of credit grantors and banks.

According to FICO, 90% of the most reputable and respected lenders today are making decisions based on this credit scoring system.

The following companies are the most popular companies that that measure credit scores: FICO, VantageScore, PLUS Score, TransUnion, Experian National Equivalency Score, Equifax, CreditXpert, and ScoreSense.

Credit scores are mostly used when obtaining loans, such as student loans, personal loans, car loans, small business loan and more. Landlords use credit score to determine if you can afford to rent an apartment. Insurance companies use it to determine how much to charge for coverage. Even some cell phone and utility companies use credit scores. It is used by banks, credit grantors, retailers, landlords and various types of lenders to determine how creditworthy you are.

Having good credit means that you will get any financing you need or rent any apartment you want. And when it comes to interest, you will be offered the lowest interest rates. On the other hand, having a bad credit score means that you will be denied different types of credit. Lenders will see you as a very risky borrower and will most likely not approve your loan application. Even some landlords will deny you a lease if your credit score is bad.

Boat loans with a 333 credit score

If your credit score is 333, then you can still find boat loan providers, even though it will be difficult. This is considered poor credit and any boat loan might come with high interest rates, since you are labelled as a sub-prime borrower.

Rock Solid Funding Boat Loan

Even if you don't have a credit score, Rock Solid Funding will still provide you with a loan that has low rates that range from 3.99% and 18.95% and flexible repayment terms that are between 36 and 240 months. The minimum loan amount is $2,500 with no maximum.

Lending Tree Boat Loan

Lending Tree doesn't directly fund loans, but they can help borrowers find a lender that can fund their boat loan when they have bad credit. Terms depend entirely on what you agree with the lender, and the minimum loan amount is $1,000.

AMS Financial Boat Loan

Any credit score is acceptable when you want to get a boat loan from AMS Financial. You can borrow up to $30,000 and pay it over 10 years at a fixed interest rate of 7%.

How is my 333 credit score calculated?

Lenders need to judge if you're a credit-worthy individual before they give you a loan or whatever financing you need. That is where your credit comes in handy. Most lenders look at your FICO score, since it is the most widely used credit score, to determine your credit-worthiness. The specifics of how FICO calculate the score are not known, but it all boils down to the information on your credit report. Your credit report is made up of the following components: payment history (35%), the amount owed (30%), the length of credit history (15%), new credit (10%), and types of credit used (10%).

Payment History

This is one of the essential components, and it accounts for 35% of your credit score. It shows lenders that you have the ability to pay your bills on time. It digs deeper into your payment history to see if any past problems exist, such as delinquency, bankruptcy, and collections. It also looks into the scope of the problems and the resolution time. Your score will be impacted negatively if you have too many problems with your payment history.

Amount Owed

The amount owed is another major component and accounts for 30% of your credit score. This part looks at what you still owe lenders by looking at the types of accounts and the number of accounts in your name. Needless to say that if you owe too many people a lot of money and have too many accounts in your name, your credit score will be negatively affected because this component focuses on your current financial situation the most.

Length of Credit History

A good credit history that spans years will signal to lenders that you are a sound investment compared to someone with a history of missing payments. If you've never missed a payment in over ten years, it counts as a plus when calculating your credit score. This component accounts for 15% of your credit score.

New Credit

If you are always getting credit (accumulating a pile of debt in the process), it must mean you have a lot of financial pressures that are compelling you to do so. Your credit score gets negatively affected every time you apply for new credit, and this component accounts for 10% of your credit score.

Type of Credit Used

This component of the credit score accounts for 10%. Basically, for each credit card you own, your credit score takes a hit. Someone with a lot of credit cards is more of a high-risk borrower than someone with only one.

Explanation of credit score ranges

When it comes to purchasing something that requires borrowing money, your credit score is the three-digit number that tells lenders if you're a worthy investment or not. Whether you are applying for a mortgage, home loan, car loan or boat loan, lenders will make a decision after looking at your credit score and other information. The higher your credit score is, the more chances you have at obtaining any loan you want at affordable interest rates (the opposite being true for low credit scores).

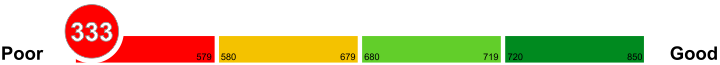

333 to 580

A credit score of 580 and below is poor credit, and approximately 61% of people with credit scores are in this range. Credit problems or bankruptcy can lead to a credit score being this low. And if you're in this range, you will find it tough to get financing or loans at all. If you do get them, the rates might not be affordable. Since people in this range are high-risk lenders, the chances of missing or failing to make payments in future (become delinquent) are high. Rebuilding your credit when it is this low will take some time, but it is worthwhile if you want to take advantage of the kind of low interest rates that the higher credit scores get.

581 to 680

Credit scores within this range are above average and count as fair. Approximately 28% of people who have credit scores fall within this range. If you are in this range, you are considered to be a high-risk borrower and will pay interest rates that are slightly higher when you try to obtain financing or loans. The chances of you becoming delinquent in future are also high.

680 to 720

Borrowers in this range are considered to have a good credit score, and they make up approximately 8% of the population of people with credit scores. Your application for financing and loans are considered to be "acceptable," and you have a good chance of getting affordable rates when you apply for loans. There is a high chance of borrowers in the 680 to 720 range to become delinquent in future.

721 to 850

Credit scores in this range are considered to be excellent, and approximately 3% of people with credit scores are in this range. If you have a credit score that falls within this range, you won't find it hard to acquire loans, and you will get much lower rates. There is a high probability of borrows in the 721 to 850 range to become highly delinquent in future.

What does it mean to have a 333 credit score

Having a credit score of 333 is not good since it is the lowest credit score that anyone can get. In fact, having a credit score that is below 580 is considered to be poor credit. You have to focus on rebuilding your credit if you want to be approved for several types of financing options. The majority of lenders won't even consider your score when it is this low.

What kind of financing can you get?

Even though finding financing will be frustrating, it is still possible to get a few lenders to give you a loan. Some banks accept all types of credit and focus on other factors when it comes to determining if a borrower can pay back a loan. So with a credit score of 333, you should expect some lenders to provide you with a car, boat, RV, personal loans and small business loans. Getting mortgages will be the hard part because banks are stringent. However, even with this credit score, you can get a home equity loan with no problem. Just as long as you own a home and have built up some equity, you can easily convert that to some quick cash to use.

Are you going to get good financing terms?

You won't get flexible terms and low interest rates with a credit score of 333 because lenders understand that they are taking a huge risk when lending you the money and would like to be rewarded as soon as possible for the risk they have taken.

Things you can do to improve your credit score of 333

Check your credit report

You should check your credit report for problems since it is what is used to calculate your credit score. If you see any errors listed on your credit report, such as incorrectly listed late payments, you should file a despite with the credit bureau to get the situation rectified and fix your credit score. Checking your credit report also helps you guard against fraudulent activity such as someone opening an account in your name fraudulently. Also, if you incorrectly entered some information, such as a wrong address, this is your chance to fix it before it becomes an issue.

At this level, your credit score is terrible, and you need to cover all your bases to make sure that no further harm gets done to your credit score by checking your credit report for errors, mistakes and any fraudulent activity.

Reduce the amount of debt you owe

Reducing debt goes beyond just improving your credit score and signifies to lenders that you're not a high-risk borrower. Check your credit card report to see how much you owe and stop using all your credit cards immediately, so you don't pile up any more debts.

Low credit scores usually mean you have accumulated quite a bit of debt and should focus on lowering it as much as possible, so it doesn't harm your credit score anymore. You should concentrate on paying your bills on time and establishing a good payment history.

Keep balances low on credit cards

If you credit cards have high amounts outstanding, that will harm your credit score considerably. Keeping this amount low will not have a disastrous effect on your account.

Avoid maxing out your credit cards, so that credit bureaus see that you aren't an over spender.

Don't open new accounts rapidly

If you start opening new accounts rapidly, it will impact your credit score negatively. Too many new accounts will have an effect on your account average, and a low number of accounts will improve your credit score.

Avoid opening a lot of new accounts very quickly in a short period because this will harm your credit score even more.

Go for credit counseling

If you want to know how to manage your accounts responsibly, then a credit counseling agency can teach you how to do it and can even negotiate lower payments and interest rates on your behalf. This approach is not a quick fix, meaning your credit score will start improving over time.

Seeking credit counseling is ideal if your score is below 580 since credit counseling bureaus have a range of services that can help you get started in fixing your credit score.