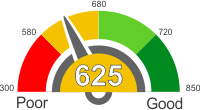

Find out what boat loans are available with a 625 credit score. Learn the things you can do to get a low interest loan and discover how to improve your credit score of 625

Your credit score is what largely determines whether you get credit or not and if the interest rates offered to you will be high or low. A credit score is a number that is calculated from the information contained in your credit report using a mathematical algorithm. The resulting number has three digits and ranges from 300 to 850.The information in the credit report is collected from the credit bureaus Transunion, Experian, and Equifax.

The credit scoring system was introduced in 1989 by Fair, Isaac, and Company, currently known as FICO. Since then, the FICO model has been adopted by a majority of credit grantors and banks.

According to FICO, 90% of the most reputable and respected lenders today are making decisions based on this credit scoring system.

The following companies are the most popular companies that that measure credit scores: FICO, VantageScore, PLUS Score, TransUnion, Experian National Equivalency Score, Equifax, CreditXpert, and ScoreSense.

Credit scores are mostly used when obtaining loans, such as student loans, personal loans, car loans, small business loan and more. Landlords use credit score to determine if you can afford to rent an apartment. Insurance companies use it to determine how much to charge for coverage. Even some cell phone and utility companies use credit scores. It is used by banks, credit grantors, retailers, landlords and various types of lenders to determine how creditworthy you are.

Having good credit means that you will get any financing you need or rent any apartment you want. And when it comes to interest, you will be offered the lowest interest rates. On the other hand, having a bad credit score means that you will be denied different types of credit. Lenders will see you as a very risky borrower and will most likely not approve your loan application. Even some landlords will deny you a lease if your credit score is bad.

Boat loans with a 625 credit score

A credit score of 625 is considered bad credit, but loan providers can still be willing to take a chance on you and provide you with a ?Bad Credit? or ?Non-prime? boat loan.

eBoat Loans Bad Credit Loans

Your credit score needs to be somewhere between 575 and 680 to qualify for this loan. You can borrow anywhere between $15,000 to 59,999 with an interest rate of 17.95% and a repayment term of 10 to 12 years.

SeaDream Bad Credit Boat Loans

If your credit score is at least 550, you can get this loan. You can borrow up to $60,000 with a repayment term of up to 12 years, but interest rates may reach the high teens.

Southeast Financial Bad Credit Boat Loans

This loan starts from $7,500 and has no maximum. You need to have a FICO credit score of 550 to be considered.

Boats Financing USA Boat Loans

With a minimum score of 550, you can get still get a loan amount greater than $100,000. The interest rates vary depending on the state you live in and your credit score. The repayment terms reach up to 20 years.

How is my 625 credit score calculated?

Lenders need to judge if you're a credit-worthy individual before they give you a loan or whatever financing you need. That is where your credit comes in handy. Most lenders look at your FICO score, since it is the most widely used credit score, to determine your credit-worthiness. The specifics of how FICO calculate the score are not known, but it all boils down to the information on your credit report. Your credit report is made up of the following components: payment history (35%), the amount owed (30%), the length of credit history (15%), new credit (10%), and types of credit used (10%).

Payment History

This is one of the essential components, and it accounts for 35% of your credit score. It shows lenders that you have the ability to pay your bills on time. It digs deeper into your payment history to see if any past problems exist, such as delinquency, bankruptcy, and collections. It also looks into the scope of the problems and the resolution time. Your score will be impacted negatively if you have too many problems with your payment history.

Amount Owed

The amount owed is another major component and accounts for 30% of your credit score. This part looks at what you still owe lenders by looking at the types of accounts and the number of accounts in your name. Needless to say that if you owe too many people a lot of money and have too many accounts in your name, your credit score will be negatively affected because this component focuses on your current financial situation the most.

Length of Credit History

A good credit history that spans years will signal to lenders that you are a sound investment compared to someone with a history of missing payments. If you've never missed a payment in over ten years, it counts as a plus when calculating your credit score. This component accounts for 15% of your credit score.

New Credit

If you are always getting credit (accumulating a pile of debt in the process), it must mean you have a lot of financial pressures that are compelling you to do so. Your credit score gets negatively affected every time you apply for new credit, and this component accounts for 10% of your credit score.

Type of Credit Used

This component of the credit score accounts for 10%. Basically, for each credit card you own, your credit score takes a hit. Someone with a lot of credit cards is more of a high-risk borrower than someone with only one.

Explanation of credit score ranges

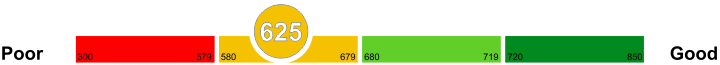

When it comes to purchasing something that requires borrowing money, your credit score is the three-digit number that tells lenders if you're a worthy investment or not. Whether you are applying for a mortgage, home loan, car loan or boat loan, lenders will make a decision after looking at your credit score and other information. The higher your credit score is, the more chances you have at obtaining any loan you want at affordable interest rates (the opposite being true for low credit scores).

300 to 580

A credit score of 580 and below is poor credit, and approximately 61% of people with credit scores are in this range. Credit problems or bankruptcy can lead to a credit score being this low. And if you're in this range, you will find it tough to get financing or loans at all. If you do get them, the rates might not be affordable. Since people in this range are high-risk lenders, the chances of missing or failing to make payments in future (become delinquent) are high. Rebuilding your credit when it is this low will take some time, but it is worthwhile if you want to take advantage of the kind of low interest rates that the higher credit scores get.

581 to 680

Credit scores within this range are above average and count as fair. Approximately 28% of people who have credit scores fall within this range. If you are in this range, you are considered to be a high-risk borrower and will pay interest rates that are slightly higher when you try to obtain financing or loans. The chances of you becoming delinquent in future are also high.

680 to 720

Borrowers in this range are considered to have a good credit score, and they make up approximately 8% of the population of people with credit scores. Your application for financing and loans are considered to be "acceptable," and you have a good chance of getting affordable rates when you apply for loans. There is a high chance of borrowers in the 680 to 720 range to become delinquent in future.

721 to 850

Credit scores in this range are considered to be excellent, and approximately 3% of people with credit scores are in this range. If you have a credit score that falls within this range, you won't find it hard to acquire loans, and you will get much lower rates. There is a high probability of borrows in the 721 to 850 range to become highly delinquent in future.

What does it mean to have a 625 credit score

A credit score of 625 is still bad credit, but it is in the range of acceptability for most lenders since they might also specialize in giving out bad credit loans to their prospective borrowers. There are plenty of subprime loans available for you here but not at the low interests rate and flexible terms you'd expect if your credit score was a bit higher, like 630. Luckily for you, you can start repairing your credit score easily and see results very quickly to get to 630.

What type of financing can you get?

As mentioned earlier, a majority of lenders usually have loans available for people with such bad credit, whether they are looking for a conventional loan, FHA loan, home equity loan, car loan, boat loan, RV loan, small business loan and various types of refinancing. As long as you keep your credit score above 550, the likelihood that lenders will deny your loan application is reduced compared to someone who's credit score is below that threshold.

Are you going to get good financing terms?

Some lenders might be able to provide you with good terms with a credit score of 625, but this is only likely if your credit report shows that you are actively trying to repair your bad credit. Otherwise, even if you won't get charged the exorbitant interest rates of someone with a poor credit score, like 300 0r 450, you still won't get very low interest rates. Lenders still consider you to be a high-risk borrower, with a high chance of defaulting on your loans in the future.

Things you can do to improve your credit score of 625

Check your credit report

The credit records of an individual are the ones that are used to calculate the credit score. People should, therefore, check if the reports have a problem that may hinder the correct score from being obtained. Many errors tend to be noted in the credit scores. The most common error encountered is late payments incorrectly listed. When you find any error, it is recommended to file a dispute immediately. The dispute is submitted to the credit bureau, so that fix the problem. Regular monitoring of the credit report also helps to guard against unlawful activities. It also gives one an opportunity to make changes to the wrong information provided or may have changed to avoid trouble.

The credit score within this range is considered good. However, there is need to continually monitor the credit records to identify any issues that may be there. This means the ability to raise a dispute. Also, you are able to identify any errors that may negatively affect the score in the future such as fraudulent activity.

Reduce the amount of debt you owe

Many benefits come with reducing one's debt. The individual can improve their credit score which enhances the ability to get more credit. Also, it sends a good picture to lenders making it easy to negotiate rates and monthly payments. It is important to keep a record of the amount one owes and minimize increasing the number until all debt is settled.

Reducing the debt that one owes is good irrespective of a good or bad credit score. Paying debt regularly as scheduled and on time significantly improves the score. Also, it works to enrich the credit history increasing the chances of obtaining credit in future.

Don't get old debt removed

Having a rich history improves all aspects of life. The same principle applies when it comes to credit history. A good history of all debts paid builds a credit score. When this account is removed, the credit score is lowered therefore negatively affecting the borrower. The score is lowered because you are removing good credit history from you active balances. You should strive to keep all good credit history to maintain the score.

A good credit history works to build your record. These includes good payment history. You should make sure to keep these records in your file so as to help maintain your good credit score. The removal of the files may negatively affect the credit score and financial status.

Negotiate outstanding balances

When a massive debt affects your credit score, there are ways to remedy the situation. The best way to do that is by negotiation. Negotiate with the lender to have interest rates and monthly payments that you can manage. However, the rate should also be favorable for the lender for you to reach an agreement.

Being in this credit score category gives you the opportunity to negotiate. It is important to negotiate your interest rate, monthly payments and other payment terms. This enables you to get reasonable terms that you can comfortable pay. Also, the chances of reducing your credit score are minimized.

Go for credit counseling

Many people do not know how to manage their accounts properly. If you are such a person, it is advisable to engage the services of a credit counseling agency. The company will help identify what you are doing wrong and contribute to making changes. In addition, they will enable you to enforce practices that improve your score such as timely payments. Finally, they may be able to negotiate great rates and payments for future credit.

Not everyone is able to negotiate on their behalf successfully. If you are such a person, seek the services of a credit bureau. They will educate you on what terms are right for you. In addition, you will gain skills on how to manage your finances so as to maintain a healthy score.