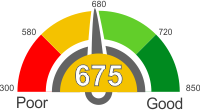

Find out what boat loans are available with a 675 credit score. Learn the things you can do to get a low interest loan and discover how to improve your credit score of 675

Your credit score is what largely determines whether you get credit or not and if the interest rates offered to you will be high or low. A credit score is a number that is calculated from the information contained in your credit report using a mathematical algorithm. The resulting number has three digits and ranges from 300 to 850.The information in the credit report is collected from the credit bureaus Transunion, Experian, and Equifax.

The credit scoring system was introduced in 1989 by Fair, Isaac, and Company, currently known as FICO. Since then, the FICO model has been adopted by a majority of credit grantors and banks.

According to FICO, 90% of the most reputable and respected lenders today are making decisions based on this credit scoring system.

The following companies are the most popular companies that that measure credit scores: FICO, VantageScore, PLUS Score, TransUnion, Experian National Equivalency Score, Equifax, CreditXpert, and ScoreSense.

Credit scores are mostly used when obtaining loans, such as student loans, personal loans, car loans, small business loan and more. Landlords use credit score to determine if you can afford to rent an apartment. Insurance companies use it to determine how much to charge for coverage. Even some cell phone and utility companies use credit scores. It is used by banks, credit grantors, retailers, landlords and various types of lenders to determine how creditworthy you are.

Having good credit means that you will get any financing you need or rent any apartment you want. And when it comes to interest, you will be offered the lowest interest rates. On the other hand, having a bad credit score means that you will be denied different types of credit. Lenders will see you as a very risky borrower and will most likely not approve your loan application. Even some landlords will deny you a lease if your credit score is bad.

Boat loans with a 675 credit score

Most Banks or loaners classify a credit score of 675 as fair. They assume you are responsible with your credit but might have had recent challenges lowering your score. This makes it easy to get a loan if you approach the right financier. Here are some suggestions.

Boat Financing USA

They finance loans between $5,000 and $75,000 with no down payment. You are required to pay no down payment, but the boat must have a maximum length of 28?. You must also provide your source of income before approval. Terms are up to 12 years.

Insight Credit Union by Equal Housing Lender

This option is available to educators and school employees. Members are eligible for up $8,000 at just 8% APR. The loan is to be paid within 48 months with payment of 24.42% for every $1,000 borrowed. The minimum loan is $2,500.

Chart way Federal Credit Union

One can get a loan of up to $25,000 payable for up to 60 months at 4.64 APR. The monthly contribution is $1065. Note that this rate is only for new boats.

How is my 675 credit score calculated?

Lenders need to judge if you're a credit-worthy individual before they give you a loan or whatever financing you need. That is where your credit comes in handy. Most lenders look at your FICO score, since it is the most widely used credit score, to determine your credit-worthiness. The specifics of how FICO calculate the score are not known, but it all boils down to the information on your credit report. Your credit report is made up of the following components: payment history (35%), the amount owed (30%), the length of credit history (15%), new credit (10%), and types of credit used (10%).

Payment History

This is one of the essential components, and it accounts for 35% of your credit score. It shows lenders that you have the ability to pay your bills on time. It digs deeper into your payment history to see if any past problems exist, such as delinquency, bankruptcy, and collections. It also looks into the scope of the problems and the resolution time. Your score will be impacted negatively if you have too many problems with your payment history.

Amount Owed

The amount owed is another major component and accounts for 30% of your credit score. This part looks at what you still owe lenders by looking at the types of accounts and the number of accounts in your name. Needless to say that if you owe too many people a lot of money and have too many accounts in your name, your credit score will be negatively affected because this component focuses on your current financial situation the most.

Length of Credit History

A good credit history that spans years will signal to lenders that you are a sound investment compared to someone with a history of missing payments. If you've never missed a payment in over ten years, it counts as a plus when calculating your credit score. This component accounts for 15% of your credit score.

New Credit

If you are always getting credit (accumulating a pile of debt in the process), it must mean you have a lot of financial pressures that are compelling you to do so. Your credit score gets negatively affected every time you apply for new credit, and this component accounts for 10% of your credit score.

Type of Credit Used

This component of the credit score accounts for 10%. Basically, for each credit card you own, your credit score takes a hit. Someone with a lot of credit cards is more of a high-risk borrower than someone with only one.

Explanation of credit score ranges

When it comes to purchasing something that requires borrowing money, your credit score is the three-digit number that tells lenders if you're a worthy investment or not. Whether you are applying for a mortgage, home loan, car loan or boat loan, lenders will make a decision after looking at your credit score and other information. The higher your credit score is, the more chances you have at obtaining any loan you want at affordable interest rates (the opposite being true for low credit scores).

300 to 580

A credit score of 580 and below is poor credit, and approximately 61% of people with credit scores are in this range. Credit problems or bankruptcy can lead to a credit score being this low. And if you're in this range, you will find it tough to get financing or loans at all. If you do get them, the rates might not be affordable. Since people in this range are high-risk lenders, the chances of missing or failing to make payments in future (become delinquent) are high. Rebuilding your credit when it is this low will take some time, but it is worthwhile if you want to take advantage of the kind of low interest rates that the higher credit scores get.

581 to 680

Credit scores within this range are above average and count as fair. Approximately 28% of people who have credit scores fall within this range. If you are in this range, you are considered to be a high-risk borrower and will pay interest rates that are slightly higher when you try to obtain financing or loans. The chances of you becoming delinquent in future are also high.

680 to 720

Borrowers in this range are considered to have a good credit score, and they make up approximately 8% of the population of people with credit scores. Your application for financing and loans are considered to be "acceptable," and you have a good chance of getting affordable rates when you apply for loans. There is a high chance of borrowers in the 680 to 720 range to become delinquent in future.

721 to 850

Credit scores in this range are considered to be excellent, and approximately 3% of people with credit scores are in this range. If you have a credit score that falls within this range, you won't find it hard to acquire loans, and you will get much lower rates. There is a high probability of borrows in the 721 to 850 range to become highly delinquent in future.

What does it mean to have a 675 credit score

A credit score of 675 is still bad credit, but it is in the range of acceptability for most lenders since they might also specialize in giving out bad credit loans to their prospective borrowers. There are plenty of subprime loans available for you here but not at the low interests rate and flexible terms you'd expect if your credit score was a bit higher, like 630. Luckily for you, you can start repairing your credit score easily and see results very quickly to get to 630.

What type of financing can you get?

As mentioned earlier, a majority of lenders usually have loans available for people with such bad credit, whether they are looking for a conventional loan, FHA loan, home equity loan, car loan, boat loan, RV loan, small business loan and various types of refinancing. As long as you keep your credit score above 550, the likelihood that lenders will deny your loan application is reduced compared to someone who's credit score is below that threshold.

Are you going to get good financing terms?

Some lenders might be able to provide you with good terms with a credit score of 675, but this is only likely if your credit report shows that you are actively trying to repair your bad credit. Otherwise, even if you won't get charged the exorbitant interest rates of someone with a poor credit score, like 300 0r 450, you still won't get very low interest rates. Lenders still consider you to be a high-risk borrower, with a high chance of defaulting on your loans in the future.

Things you can do to improve your credit score of 675

Setup payment reminders

Your credits score improves when you make payments on time; it is one of the biggest determining factors when calculating your credit score. You can tell the lender to send you reminders via email, phone call or text if they don't already have an automated system or portal in place.

At this point, you don't want to miss a payment. So it is worthwhile to set up reminders in your calendar or tell your lenders to remind you through email, phone or text when payments are due.

Get current and stay current

Your recent payment history weighs more than your history from six months ago when it comes to calculating your credit score. So once you establish a good payment history, it is vital to keep it positive to improve your credit score. Any information that tells the credit bureaus that you're managing your credit well will always be good for your credit score.

With this credit score, it is a great time to let the credit bureau know that you are managing your credit well by ensuring that your recent payment history reflects nothing but on-time payments. Remember that your past bad credit won't put a damper on your credit forever and focusing on the latest history should be a priority since it has more weight when it comes to calculating your credit score.

Become an authorized user

Sometimes you can opt to be an authorized user on another person's credit card. Being an authorized user will make the other person's excellent payment history, with all the payments they made on time, reflect on your credit report as well, boosting your credit score in the process.

Become an authorized user of someone with a higher score and let their good payment history reflect on your credit score. This will help you enter the range of excellent credit.

Keep balances low on credit cards

If you credit cards have high amounts outstanding, that will harm your credit score considerably. Keeping this amount low will not have a disastrous effect on your account.

30% credit card utilization is ideal if you want to show the credit bureau that you are not an over-spender. Keeping the credit card balances low will increase your credit score next time you submit your credit report.

Check if you linked your account to others

Sometimes, people such as friends, spouses and family members can link their credit ratings via joint accounts. If someone's bad credit is hurting yours, it might be time to cut that link so you can raise your credit score.

You're in the good range for now and don't want someone else's bad credit history to weigh you down. If you linked your account to someone with bad credit, you have to make sure your accounts get unlinked by the next time you submit a credit report.