Find out what boat loans are available with an 850 credit score. Learn the things you can do to get a low interest loan and discover how to improve your credit score of 850

Your credit score is what largely determines whether you get credit or not and if the interest rates offered to you will be high or low. A credit score is a number that is calculated from the information contained in your credit report using a mathematical algorithm. The resulting number has three digits and ranges from 300 to 850.The information in the credit report is collected from the credit bureaus Transunion, Experian, and Equifax.

The credit scoring system was introduced in 1989 by Fair, Isaac, and Company, currently known as FICO. Since then, the FICO model has been adopted by a majority of credit grantors and banks.

According to FICO, 90% of the most reputable and respected lenders today are making decisions based on this credit scoring system.

The following companies are the most popular companies that that measure credit scores: FICO, VantageScore, PLUS Score, TransUnion, Experian National Equivalency Score, Equifax, CreditXpert, and ScoreSense.

Credit scores are mostly used when obtaining loans, such as student loans, personal loans, car loans, small business loan and more. Landlords use credit score to determine if you can afford to rent an apartment. Insurance companies use it to determine how much to charge for coverage. Even some cell phone and utility companies use credit scores. It is used by banks, credit grantors, retailers, landlords and various types of lenders to determine how creditworthy you are.

Having good credit means that you will get any financing you need or rent any apartment you want. And when it comes to interest, you will be offered the lowest interest rates. On the other hand, having a bad credit score means that you will be denied different types of credit. Lenders will see you as a very risky borrower and will most likely not approve your loan application. Even some landlords will deny you a lease if your credit score is bad.

Boat loans with an 850 credit score

An 850-credit score is considered a good credit score and will qualify you to a lot more Financial Loans Programs provided by Insurance Companies.

My Financing USA

My Financing USA requires boats loaned to be a 2009 model or newer. Borrowers need to agree with the 15% Down Payment and a low debt ratio to be qualified for their good credit boat loans program. This financing company can adjust the terms depending on how low or how high your credit score is.

U.S. Bank Association

U.S. Bank Association lends boats with a cost between $5,000 and $150,000. Borrowers must be 18 years of age and a legal resident of the United States to be qualified.

Southeast Financial

Southeast Financial offers an easy online application that's complete and secure. They have a minimum boat loan amount of $10,000 compared to the $25,000 by other Insurance Companies.

How is my 850 credit score calculated?

Lenders need to judge if you're a credit-worthy individual before they give you a loan or whatever financing you need. That is where your credit comes in handy. Most lenders look at your FICO score, since it is the most widely used credit score, to determine your credit-worthiness. The specifics of how FICO calculate the score are not known, but it all boils down to the information on your credit report. Your credit report is made up of the following components: payment history (35%), the amount owed (30%), the length of credit history (15%), new credit (10%), and types of credit used (10%).

Payment History

This is one of the essential components, and it accounts for 35% of your credit score. It shows lenders that you have the ability to pay your bills on time. It digs deeper into your payment history to see if any past problems exist, such as delinquency, bankruptcy, and collections. It also looks into the scope of the problems and the resolution time. Your score will be impacted negatively if you have too many problems with your payment history.

Amount Owed

The amount owed is another major component and accounts for 30% of your credit score. This part looks at what you still owe lenders by looking at the types of accounts and the number of accounts in your name. Needless to say that if you owe too many people a lot of money and have too many accounts in your name, your credit score will be negatively affected because this component focuses on your current financial situation the most.

Length of Credit History

A good credit history that spans years will signal to lenders that you are a sound investment compared to someone with a history of missing payments. If you've never missed a payment in over ten years, it counts as a plus when calculating your credit score. This component accounts for 15% of your credit score.

New Credit

If you are always getting credit (accumulating a pile of debt in the process), it must mean you have a lot of financial pressures that are compelling you to do so. Your credit score gets negatively affected every time you apply for new credit, and this component accounts for 10% of your credit score.

Type of Credit Used

This component of the credit score accounts for 10%. Basically, for each credit card you own, your credit score takes a hit. Someone with a lot of credit cards is more of a high-risk borrower than someone with only one.

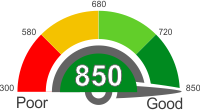

Explanation of credit score ranges

When it comes to purchasing something that requires borrowing money, your credit score is the three-digit number that tells lenders if you're a worthy investment or not. Whether you are applying for a mortgage, home loan, car loan or boat loan, lenders will make a decision after looking at your credit score and other information. The higher your credit score is, the more chances you have at obtaining any loan you want at affordable interest rates (the opposite being true for low credit scores).

300 to 580

A credit score of 580 and below is poor credit, and approximately 61% of people with credit scores are in this range. Credit problems or bankruptcy can lead to a credit score being this low. And if you're in this range, you will find it tough to get financing or loans at all. If you do get them, the rates might not be affordable. Since people in this range are high-risk lenders, the chances of missing or failing to make payments in future (become delinquent) are high. Rebuilding your credit when it is this low will take some time, but it is worthwhile if you want to take advantage of the kind of low interest rates that the higher credit scores get.

581 to 680

Credit scores within this range are above average and count as fair. Approximately 28% of people who have credit scores fall within this range. If you are in this range, you are considered to be a high-risk borrower and will pay interest rates that are slightly higher when you try to obtain financing or loans. The chances of you becoming delinquent in future are also high.

680 to 720

Borrowers in this range are considered to have a good credit score, and they make up approximately 8% of the population of people with credit scores. Your application for financing and loans are considered to be "acceptable," and you have a good chance of getting affordable rates when you apply for loans. There is a high chance of borrowers in the 680 to 720 range to become delinquent in future.

721 to 850

Credit scores in this range are considered to be excellent, and approximately 3% of people with credit scores are in this range. If you have a credit score that falls within this range, you won't find it hard to acquire loans, and you will get much lower rates. There is a high probability of borrows in the 721 to 850 range to become highly delinquent in future.

What does it mean to have an 850 credit score

An 850 credit score is the highest available under FICO. The approval rate is rather fast. Only 18% of the population are in the 800-850 credit score range. It shows lenders that the individual is an excellent investment with little risk. It is important to know that acquiring a loan affects a credit score because of the inquiry. People with this score are advised to minimize the loans taken at a time even though many are available. They are eligible for all types of loans.

Large loans

The loan amounts available are larger when compared to the other credit score categories. The amounts enable one to engage in investments or payment of expenses. Also, the score also keeps you away from high fees, penalties, and deposits

Minimal documentation

The score builds great trust with the lenders. In return, the need to provide too much background information is reduced. For lower credit scores, the lenders require comprehensive information such as work history, physical address, income reports, proof of income and financial documents.

Interest rate

The interest rate are very low with some at 3%. Also, the monthly payments become smaller, and the loan may also be extended over an extended period. The terms make it possible to make the payments without much problem and maintaining the good score.

Things you can do to improve your credit score of 850

850 is an excellent credit score that should get you access to more loan options. However, you can easily damage it if you are not careful on the debt you get yourself into. Your only worry is to maintain this perfect rating while at the same time making use of credit facilities available. The following suggestions can help you improve on it.

Continue paying your bills on time

Just because you have a perfect credit rating doesn?t mean you are exempted from paying your dues punctually. All borrowers are treated equally by lenders. Your rating may be damaged when you ignore the deadlines or fail to pay the minimum monthly payment.

Scrutinize your credit report

The smallest mistake on your credit report can lead to the lowering of your rating. An error of even 0.001 has a negative implication on your score especially if you have taken a huge loan attracting a high interest. Therefore, it is necessary to ensure that every detail is recorded correctly and nothing is misreported.

Renegotiate the credit terms if necessary

You may run into financial difficulties that make it hard for you to pay a loan as per the terms. You can talk to your lender to ease the repayment terms to prevent you from being listed as a defaulter.