Find out the credit cards that you can get with a credit score below 800 and learn what you can do to improve your credit score.

A credit score is needed for you to be able to get a loan or credit. The reason behind this is because it will help financial institutions to determine your creditworthiness. They will also see every loan that you made and the payment history that you have. Find out more about it by reading the information below.

Credit scores are calculated based on the proprietary algorithm. This will include the person's outstanding debts, payment history, and the length of the individual's credit history.

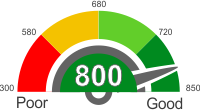

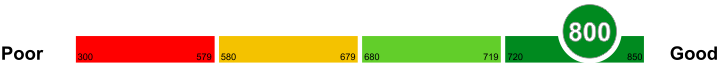

Credit scores can range from 300 to 850. The higher the individual's score, the lower the risk. People who have lower credit scores are considered high risk, which will make lending companies ask for more requirements.

About Fico scores

Fair Isaac Corporation is the one who established FICO, and it is one of the most commonly used credit scoring systems today.

According to FICO, 90% of the most reputable and respected lenders today are making decisions according to this kind of credit scoring system. Get to know more about Fico scores by reading the information below.

How are credit scores calculated?

The weight of each of the five categories are; 30% of amount owned, 10% is for the new credit, 15% accounts for the length of credit history, 10% is the credit mix and the last 35% accounts for the person's payment history.

The FICO score takes into consideration positive as well as negative aspects of the credit report. The percentage or the weight of any of the categories mentioned above may differ from a person to another depending upon the information available in the credit report.

The FICO score takes all of the information from your credit report. However, the banks or any other lending institution might look at your income, type of credit and employment history when you apply for a loan or mortgage.

Once a certain lender asks for a client's credit report, they can also ask for the Fico score. Other sources say that your Fico score will include 35% of your payment history, 30% of your credit utilization, and 15% as to how long have you been borrowing.

Explanation of credit score ranges

It is important to know the category that you fall into when it comes to credit score for you to be aware. The range of a credit score can go from 300 to 850. Always remember that the higher your score, the higher the chances of you to qualify for a loan. There will also be instances where a financing company is okay with 650 scores, while the other is fine with a 750 score. It will all depend on the lender itself.

A lender or a bank will check your credit score if you qualify for the application that you are requesting. Here are some of the credit score ranges that you should know.

Bad credit score

People with a credit score below 579 is known as high risks. Foreclosures, poor payment history, and bankruptcies are the reasons why people fall into this category.

Good credit score

A good credit score ranges from 680 to 719. People with this credit score can expect approvals and interest rates that are better.

Very Good

A very good credit score ranges from 720 to 799. People with this credit score is known to be small risks, and they often get loan amounts that are higher than usual.

Excellent

An excellent score ranges from 800 and above. Financial freedom is expected to people with this score.

What does it mean to have a credit score of 800

A credit score of 800 is extremely important. This credit score is good for all parts of your financial life. At a credit score of 800, you are legible for good loans. Good loans are those with low-interest rates. A credit score of 800 and above may seem unreachable for many people, but there is a significant percentage of people who reach the cap. Having a credit score of 800 is rather impressive but not necessary if you want to save money, a range of within 800 is good enough for saving money because you still start borrowing loans with low-interest rates. At 800 you will see tangible results, and you are the person who is considered as having walked through financial freedom. A credit score of 800 is seen as magic credit score that might get you what you want within a financial freedom arena.

Is it achievable?

Reaching a credit score of 800 is realistic. It is a goal that will walk you to 850 and is there within your reach. Remember that you cannot get a credit score of 800 overnight. To build trust with credit companies and lenders that will get your healthy credit report to 800 are things that happen with years as compared to months. Financial advisors will be quick to tell you that you should be prepared for a long run

Saving money with your 800 score

When you have more than you spend, you are considered as having reached financial freedom. Utilize your near perfect credit score to save money. In addition to saving it is rather good to know that a credit score of 800 is a credit for credibility and not a credit for luxury. Work it upwards because you have a few scores to reach your perfect credit score.

Things you can do to improve your credit score of 800

A score of 800 and above means that you have an excellent credit rating. It should not stop you from maintaining or improving it. You should not get too comfortable and take things for granted to a point where you forget your financial obligations. Doing this means that your credit rating my end up being damaged.

Increase your credit limit

This action improves you're the ratio of your credit utilization, which refers to the proportion of the credit limit you use versus what is available. Make a request for credit line increase, but if the lender intends to do a hard pull you can withdraw since it lowers your credit.

Tighten your privacy and security

Fraudsters may open credit accounts in your name without your name. Ensure you read your periodical reports to ensure they don't contain credit you haven't solicited. Don't share too much personal information on social media that fraudsters can take advantage of.

Clear your debts

Ensure that you owe no lender any outstanding amount. Even a $0.1 could have an impact on your credit score since it is still considered debt; worse still, it could be attracting interest. Lenders cannot trust you if you have long-running debts.