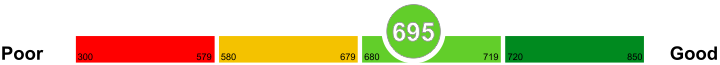

Learn what credit cards you can get with a credit score of 695 and understant the things you can do to better your credit score.

A credit score is needed for you to be able to get a loan or credit. The reason behind this is because it will help financial institutions to determine your creditworthiness. They will also see every loan that you made and the payment history that you have. Find out more about it by reading the information below.

Credit scores are calculated based on the proprietary algorithm. This will include the person's outstanding debts, payment history, and the length of the individual's credit history.

Credit scores can range from 300 to 850. The higher the individual's score, the lower the risk. People who have lower credit scores are considered high risk, which will make lending companies ask for more requirements.

Credit cards you can get with a credit score of 695

Getting credit cards with a credit score of 695 can be easier than you think since this is known as a pretty fair score.

Banks consider a credit score of 695 a good score, which is why granting a credit card is easy. But put in mind that not all banks will be considerate enough to approve your application. Here are some of the banks that cater to people with a credit score of 695.

Sony Card from Capital One

Sony Card from Capital One has no annual fee and has a 0% intro APR until 2017 May. Upon purchasing within the first 90 days, you can earn bonus points of 5,000. If you buy from the Sony store, you can earn 5 points for every USD 1.

Chase Freedom

Chase Freedom offers no annual fee and has a 0% APR for the first 15 months. It also has a 5% cash back for a combined purchase of USD 1,500.

About Fico scores

Fair Isaac Corporation is the one who established FICO, and it is one of the most commonly used credit scoring systems today.

According to FICO, 90% of the most reputable and respected lenders today are making decisions according to this kind of credit scoring system. Get to know more about Fico scores by reading the information below.

How are credit scores calculated?

The weight of each of the five categories are; 30% of amount owned, 10% is for the new credit, 15% accounts for the length of credit history, 10% is the credit mix and the last 35% accounts for the person's payment history.

The FICO score takes into consideration positive as well as negative aspects of the credit report. The percentage or the weight of any of the categories mentioned above may differ from a person to another depending upon the information available in the credit report.

The FICO score takes all of the information from your credit report. However, the banks or any other lending institution might look at your income, type of credit and employment history when you apply for a loan or mortgage.

Once a certain lender asks for a client's credit report, they can also ask for the Fico score. Other sources say that your Fico score will include 35% of your payment history, 30% of your credit utilization, and 15% as to how long have you been borrowing.

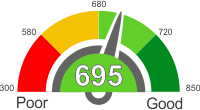

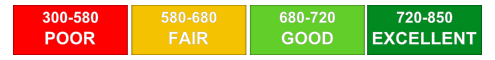

Explanation of credit score ranges

It is important to know the category that you fall into when it comes to credit score for you to be aware. The range of a credit score can go from 300 to 850. Always remember that the higher your score, the higher the chances of you to qualify for a loan. There will also be instances where a financing company is okay with 650 scores, while the other is fine with a 750 score. It will all depend on the lender itself.

A lender or a bank will check your credit score if you qualify for the application that you are requesting. Here are some of the credit score ranges that you should know.

Bad credit score

People with a credit score below 579 is known as high risks. Foreclosures, poor payment history, and bankruptcies are the reasons why people fall into this category.

Good credit score

A good credit score ranges from 680 to 719. People with this credit score can expect approvals and interest rates that are better.

Very Good

A very good credit score ranges from 720 to 799. People with this credit score is known to be small risks, and they often get loan amounts that are higher than usual.

Excellent

An excellent score ranges from 800 and above. Financial freedom is expected to people with this score.

What does it mean to have a credit score of 695

In the United States, individuals with a credit score of 680 are regarded as the average population for determining the health of a national credit score. Therefore, if the average is approximately 680, individuals with 695 can see it an opportunity to apply different types of loans including mortgages. These individuals can also own homes and cars obtained purely from bank loans. The more good news with a credit score of 695 is that it is easy to change this credit score from 695 to above this figure. It will take only three months to reach 700. This drastic positive change is impossible when an individual has a lesser credit score.

Improving your credit score of 695

With a credit score of 695, you do not need to sit down and put your back that, you're on the safer side of financial books. The best thing you need to do to keep the credit score financial information on your fingertips and always work on improving this score. There is a lot to do with a positive credit score. Therefore, to improve from 695 and above, correct your credit history reports at least four times a year. You should know what is in your report so that you can know what is wrong and where you went wrong.

Credit reports

Financials are complex whether they are for individuals or companies. Therefore, ensure you work on obtaining your financial reports. Determine where you went wrong and start fixing errors. Some errors may be hidden, but it will be very embarrassing when lenders find these errors, especially when you're trying to make a huge loan application.

What you need to do

Work on staying on the positive side of credit score above 695. The best way to do this is continuing to work on growing your credit score through making timely payments as well as reducing credit debts. Nowadays, there is plenty of information on many websites to keep you posted on the best ways to maintaining your positive credit score and staying above 695.

Things you can do to improve your credit score of 695

With some discipline and commitment, you can keep on improving your credit score of 695. A score starting from 600 and above is considered average and can secure you many options for credit. Therefore, it is your obligation to ensure it keeps improving until it is excellent. Here are a few ways to assist you.

Open few credit cards concurrently

It is not recommended for you to open multiple credit accounts at the same time. When you do this, it reduces the average age of the accounts thus reducing your credit rating.

Avoid canceling credit cards with no annual fee

The proportion of credit that use to the total credit available to you also contributes to your credit score. When you get rid of a credit card, your credit line gets reduced thus raising the proportion. It doesn't work in your favor, and your credit score is lowered.

Maintain a low credit balance

It is recommended for you to keep your revolving credit balance to under ten percent of the total available credit. Higher ratios point to elevated credit risks. Using all of your limits reflects negatively o you credit score.