Find out the information that you need to familiarize yourself with when it comes to FICO auto industry option score.

Some people think that FICO auto industry option score is the same as FICO score.

For individuals who don't know, a FICO score is your typical score, while the auto score is the one that is only available to finance and auto dealer companies. Familiarize yourself with the FICO auto industry option score by reading the information below.

FICO Auto Industry Option Score

FICO auto industry option score is where the auto score is rating you more when it comes to managing your past car credits. Lending companies main concerns are how you paid your loans before and how you're going to pay for the amount that you are going to loan.

Information Acquired from FICO Auto

The information that can be acquired from your FICO Auto are payments that you have made from your previous and current loan. The lending company can see if you have missed or late payments and if you have any repossessed cars. They can also check if you have sent an auto account to collections or if you have included your lease or car loan in bankruptcy.

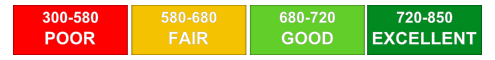

Explanation of credit score ranges

It is important to know the category that you fall into when it comes to credit score for you to be aware. The range of a credit score can go from 300 to 850. Always remember that the higher your score, the higher the chances of you to qualify for a loan. There will also be instances where a financing company is okay with 650 scores, while the other is fine with a 750 score. It will all depend on the lender itself.

A lender or a bank will check your credit score if you qualify for the application that you are requesting. Here are some of the credit score ranges that you should know.

Bad credit score

People with a credit score below 579 is known as high risks. Foreclosures, poor payment history, and bankruptcies are the reasons why people fall into this category.

Good credit score

A good credit score ranges from 680 to 719. People with this credit score can expect approvals and interest rates that are better.

Very Good

A very good credit score ranges from 720 to 799. People with this credit score is known to be small risks, and they often get loan amounts that are higher than usual.

Excellent

An excellent score ranges from 800 and above. Financial freedom is expected to people with this score.

How are credit scores calculated?

The weight of each of the five categories are; 30% of amount owned, 10% is for the new credit, 15% accounts for the length of credit history, 10% is the credit mix and the last 35% accounts for the person's payment history.

The FICO score takes into consideration positive as well as negative aspects of the credit report. The percentage or the weight of any of the categories mentioned above may differ from a person to another depending upon the information available in the credit report.

The FICO score takes all of the information from your credit report. However, the banks or any other lending institution might look at your income, type of credit and employment history when you apply for a loan or mortgage.

Once a certain lender asks for a client's credit report, they can also ask for the Fico score. Other sources say that your Fico score will include 35% of your payment history, 30% of your credit utilization, and 15% as to how long have you been borrowing.

Car financing options based on credit score

There are a lot of car financing options based on a person's credit standing, but most financial companies have different rates. Usually, the higher your rating, the lower the interest rate. Same goes for people who have a lower credit score, the lower the score, the higher the rating.

Current Car Financing Options

One of the known financing companies today is Capital One, wherein they have 60 months term and their rate for the said duration is 3.19%. This kind of loan will cost you USD 361 of monthly dues. Car Finance company also has a 60 months terms, but the rate is higher at 7.25%, with monthly payment dues of USD 398.

Car Dealership

You can also prefer talking to a car dealership as they usually have different finance options that will meet up to your standards. There are also some that work with the bank or lenders, which can help you with your car loan needs.