Learn what it means to have a FICO of 362. Understand how it's calculated, what loans you can obtain, and how to better your FICO score

A credit score is needed for you to be able to get a loan or credit. The reason behind this is because it will help financial institutions to determine your creditworthiness. They will also see every loan that you made and the payment history that you have. Find out more about it by reading the information below.

Credit scores are calculated based on the proprietary algorithm. This will include the person's outstanding debts, payment history, and the length of the individual's credit history.

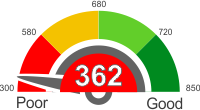

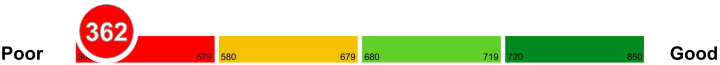

Credit scores can range from 300 to 850. The higher the individual's score, the lower the risk. People who have lower credit scores are considered high risk, which will make lending companies ask for more requirements.

About Fico scores

Fair Isaac Corporation is the one who established FICO, and it is one of the most commonly used credit scoring systems today.

According to FICO, 90% of the most reputable and respected lenders today are making decisions according to this kind of credit scoring system. Get to know more about Fico scores by reading the information below.

How FICO is calculated

Different grade scales are used around the world, but the most commonly used system is the FICO score. FICO stands for Fair Isaac Corporation, which is responsible for calculating your FICO score.

FICO has not declared any detailed explanation on how the FICO score is calculated. However, some of the important variables considered in determining your credit score are as follows:

First and foremost, your payments are considered in calculating your FICO score. It comprises for almost 35 % of your FICO score. Next, 30 % of the score is calculated by your debts. Your length of credits accounts for next 15 %, followed by the type of credit used and some inquiries made for credit hold 10 % value each in FICO scores.

Explanation of FICO ranges

If you are wondering about the explanation of FICO ranges, then reading the information below will help.

Having knowledge about the credit score is essential as this can give a huge impact on your future. Knowing your credit score will help you know the credit worthiness that you have. Here are the explanation of FICO ranges.

579 and Below

579 and below means you have a poor FICO. Lenders may require a certain amount of deposit before granting your application.

670 to 739

670 to 739 is a good FICO; wherein borrowers are considered as acceptable.

740 to 799

740 to 799 is a very good FICO; wherein borrowers can expect better interest rates.

800 and Above

800 and above is an exceptional FICO and people with this score are quickly approved of their application.

What does it mean to have a FICO of 362

A FICO score of 362 is still considered bad credit. This score can impede the chances of you getting credit cards, and at this point, loans and credits are not yours. You will still not do anything that deals with borrowing. Most lenders will deny your loan application based on this FICO score. It is most likely going to have a higher interest rate, and this is not going to take you anywhere far. Other lenders will approve your loan application with a poor FICO score, but they will do it after you have parted with a large down payment or present a co-signer who will act as a guarantee. If you are seeking insurance with this bad credit, you are likely to pay high-interest rates.

Factors contributing to this score

The factors that contribute to poor credit score include the combination of late repayments, bankruptcy, collections, and high balances on your credit cards. Applying for too much credit within a very short time will drag down your credit score especially when you make late payments on several credits. Even though you might be able to repay your loans on time, it is difficult to balance early repayment when you have too much credit to pay especially in a financially fluctuating economy.

What to avoid

The following factors always contribute to a FICO score of 362. Payment history, the total amount owed, the length of credit history, the type of credit in use, and new credit. Lenders want to know all that you have recently done within your financial history so that they can determine your credit worth. You should also understand the magnitude of the use of your credit history.

Credit cards with a FICO of 362

Getting credit cards with a FICO of 362 can be difficult, which is why improving your score is important.

A FICO can range between 300 to 850. A 362 score means that you missed a payment or paid your bill late. Different factors can affect your credit score, which is why knowing how you can prevent these elements is essential.

Payment History

Your payment history can affect your FICO. If you still have unpaid bills, it is wise to pay them now. Always see to it that you are paying each and every bill on time, to avoid lowering your score even more. Thus, paying them on time will increase your score.

Avoid Closing Accounts

If you own multiple credit cards but only using a few, it would be best to avoid closing the unused ones. The reason behind this is because it can affect the balance to limit ratio, which will then lower your FICO.

Car loans with a FICO of 362

It can be challenging to get car loans with a FICO of 362, but there are financing companies who are willing to give you a chance.

Lending companies are being cautious when it comes to approving loans to people who have a FICO of 362, for the obvious reason that this is a profoundly low score. If you are willing for the challenge of getting approved, then knowing the things you can expect from these companies would be ideal.

High-Interest Rate

Lending companies will probably approve your application but with a high-interest rate. The reason behind this is because you are known as a high-risk client. You can try negotiating the price, but it will all be up to the company.

Higher Down Payments

Some will also require a down payment from you. Typically the down payment will depend on the amount that you are borrowing. The down payment will range from 10 to 20% of your total loan.

Mortgages with a FICO of 362

With a FICO rating of 362, you will fail to get the top home loan or mortgage offers available in the market. With this score, they will consider a high risk of defaulting on your credit payments. Therefore, you should search for ways to improve your FICO score for the future.

With this score, you can get yourself a credit card. The credit card companies pay little or no interest in your credit score. You can use the credit through your credit card for you home or mortgage.

You can also search the internet for online lenders. A number of people are willing to lend you money online with manageable requirements or conditions.

Home Loans with a FICO of 362

The FICO score ranges from 300 to 850, with higher score showing a robust and better credit history. The lower your score, minimal is your chances of getting a home loan. With a score as low as 362, it is almost impossible to get a loan from a reputable bank.

However, this doesn't mean that you are out of options and have to give up on your pursuit of getting a home loan. There are several options that you may want to look at.

You can start by searching for online lenders as they pay little attention to your FICO score. If you have a credit card or looking to get one in near future, you might want to look at the interest rates that you will be paying if you finance your home loan through credit card.

Personal Loans with a FICO of 362

You are not able to secure significant amounts with this FICO score. It is recommended that you take a personal loan when it is necessary. You are not strong financially at this score, and most lenders tend to reject your personal loan requests. When approved, you are given unfavorable loan terms.

Co-signer loan

You can find another person to be a signatory for your loan request. It means that the other person may be held liable if you default on payment. Find someone who can trust you since their FICO score risks damage when you are unable to pay.

Pawn shop loan

Pawn shops are located at the corner of almost every street. They provide loans for their clients at a moment's notice. However, you need to surrender one or more of your valuable items as security for the loan you are taking.

Collateral loan

Some banks can give you a personal loan if you provide collateral for it. It could be an asset that can be liquidated to recover any outstanding amount when you are unable to pay. Most banks offer this type of loan.

Things you can do to improve your FICO of 362

A FICO score of 362 still falls under the category of poor credit. You have limited avenues for obtaining credit thus the need to improve the rating. Increasing your score comes in handy when you are in need of emergency funding. Some lenders might give you credit, but with an exorbitant annual percentage rate. Therefore, it is necessary to take measures that target at increasing your FICO score.

Verifying your accounts are current

Your payment history accounts for 35% of your FICO score making it necessary to ensure your accounts are current. Any due accounts must be paid as soon as possible. Your rating improves when you maintain a clean payment history with no late items for 12 consecutive months. The number of accounts you pay as per the credit agreement is considered in comparison to the number of accounts showing late payments, as well as the adversity of those delinquencies.

Clearing collections, charge-off, judgments, and liens

Your FICO score is damaged by old collection items, charge-offs on your credit card, and judgments and liens. You need to settle these items one at a time by directly contacting your creditors. The most recent delinquent accounts within 24 months should be resolved first since they significantly hurt your score. More weight is put on your recent credit history. Therefore, you need to negotiate with your creditors to eliminate a trade line completely by agreeing to settle the full balance of an account.

Dispute errors in your report

You are entitled to a free annual credit report from each of the three bureaus. You can increase your FICO score by having the mistakes on the report calculated. A single late payment that shouldn't be three can significantly reduce your rating. You need to do this by writing formally to the creditors and reference bureaus.