Learn what it means to have a FICO of 500. Understand how it's calculated, what loans you can obtain, and how to better your FICO score

A credit score is needed for you to be able to get a loan or credit. The reason behind this is because it will help financial institutions to determine your creditworthiness. They will also see every loan that you made and the payment history that you have. Find out more about it by reading the information below.

Credit scores are calculated based on the proprietary algorithm. This will include the person's outstanding debts, payment history, and the length of the individual's credit history.

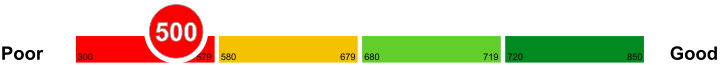

Credit scores can range from 300 to 850. The higher the individual's score, the lower the risk. People who have lower credit scores are considered high risk, which will make lending companies ask for more requirements.

About Fico scores

Fair Isaac Corporation is the one who established FICO, and it is one of the most commonly used credit scoring systems today.

According to FICO, 90% of the most reputable and respected lenders today are making decisions according to this kind of credit scoring system. Get to know more about Fico scores by reading the information below.

How FICO is calculated

Different grade scales are used around the world, but the most commonly used system is the FICO score. FICO stands for Fair Isaac Corporation, which is responsible for calculating your FICO score.

FICO has not declared any detailed explanation on how the FICO score is calculated. However, some of the important variables considered in determining your credit score are as follows:

First and foremost, your payments are considered in calculating your FICO score. It comprises for almost 35 % of your FICO score. Next, 30 % of the score is calculated by your debts. Your length of credits accounts for next 15 %, followed by the type of credit used and some inquiries made for credit hold 10 % value each in FICO scores.

Explanation of FICO ranges

If you are wondering about the explanation of FICO ranges, then reading the information below will help.

Having knowledge about the credit score is essential as this can give a huge impact on your future. Knowing your credit score will help you know the credit worthiness that you have. Here are the explanation of FICO ranges.

579 and Below

579 and below means you have a poor FICO. Lenders may require a certain amount of deposit before granting your application.

670 to 739

670 to 739 is a good FICO; wherein borrowers are considered as acceptable.

740 to 799

740 to 799 is a very good FICO; wherein borrowers can expect better interest rates.

800 and Above

800 and above is an exceptional FICO and people with this score are quickly approved of their application.

What does it mean to have a FICO of 500

Using this standardized scoring algorithm, FICO score, a borrower's credit rating ranges from 300 to 850. According to FICO categorization, a credit score of 500 is also rated as bad credit. Even though each lender set their credit requirements, the average FICO score is 695 suggesting that a FICO below this figure is regarded as bad and creditors will want to be stiff when giving credit.

Eligibility for credit

Even if your FICO is as low as 500 or range within 500, you will still get credit and loans. However, you need to understand loaning terms and conditions. Individuals with poor credit have different loan terms as compared to individuals who have a positive credit rating. For example, people with bad credit are required to deposit money to secure credit cards. Also, you may have to pay high premiums for car insurance. People with good credit do not have to pay any deposit for their credit cards. Their car insurance premiums are also reasonable and standard for that matter.

Repairing a FICO score of 500

If your FICO score is 500, you are not as bad as someone who has a negative credit history. At least you have hopes that you will work your credit up to the ladder. The normal standard rules of working your credit up the ladder apply. From the standard financial point, it is safer to work your credit health from 500 upwards as considered to looking for loans and applying for credit cards. Your income also plays a role in determining your credit worth. Use it as an opportunity to create higher score than using it to acquire more debt that will increase your risk of damaging your credit score.

Credit cards with a FICO of 500

A FICO of 500 is known as a poor score, which is why people with this score are having a hard time getting their credit cards.

Some people think that having a FICO of 500 won't give them a chance to have their cards. The good news is, there are some things that you can do to have your credit card without putting in too much effort.

Credit Card Forum

Credit Card Forum has a tool that can help you match with the best credit card offers that are available for your FICO. If there are too many matches, it would be best just to pick one since applying for more can ruin your FICO more.

Secured Credit Cards

Secured credit cards require a security deposit, which will be used as a limit for your card. Some banks require a minimum of USD 200. Some secured ones can also help you improve your credit score.

Car loans with a FICO of 500

People who need car loans with a FICO of 500 getting their application approved can be difficult. But there are certain things that you can do to get your loan.

A FICO score of 500 is classified as a bad one, which can make the approval of their loan challenging. It is truly necessary to look for a financing company that can provide the loan that they need. Fortunately, some things can be done for a company to grant you your loan.

Advanced Credit Matching

An Advanced Credit Matching software is essential as this can help you save a lot of time. The reason behind this is because all you have to do is to submit your application online and the software will be the one to match you up with companies who are accepting FICO of 500. It will also ask for your budget to ensure that they have matched you to the right lenders.

Offer a Down Payment

Offering the company a down payment for the loan that you are asking is also ideal. Companies usually grant loans from people with a low FICO, for as long as they provide a down payment.

Mortgages with a FICO of 500

If you have a FICO score of 500, you fall in the lower than average category on the grade scale. With this score, you may not be able to get above average loan options for offers for your home loan or mortgage. You will have to settle with one out of the very few options for acquiring credit.

You can go to local and small-scale banks that operate in your area. They are more willing to lend money to people with low FICO score at higher interest rates.

You can also get a credit card to finance your home loan or mortgage needs. This is possible because credit card companies are willing to give credit cards to people irrespective of their current FICO score.

Home Loans with a FICO of 500

If your FICO score lies somewhere closer or equal to 500, then the banks are going to charge you higher interest rates because of the defaulting risk on your payments. Therefore, it is only reasonable to look for other non-conventional options.

You may want to try with the FHA approved lenders, although, their minimum rate is higher than 500.

You can apply for a mortgage through a manual process. You can use by manually processing your application. In the course of doing so, if you can show last 12 months on-time payments it will improve your chances of getting the home loan.

However, all of the above fails, you might want to ask one of your about co-sign for you for getting the home loan or mortgage.

Personal Loans with a FICO of 500

With a low FICO score, you need to find a lender with transparent about rates, has flexible terms, and ready to consider you not only by the credit rating. It takes effort since most lenders out there are aiming to make a killing from them clients. Extensive research is necessary to find a suitable lender with favorable terms.

Micro-lenders

They are also known as peer to peer lenders. They are online credit service providers aiming to provide alternative financing options for individuals who miss out on traditional sources. Their services are usually customized to meet every client's requirements. You can get a loan within hours if you satisfy their criteria.

Loans from credit unions

They provide the cheapest loans when compared to other formal financial institutions. Their aim is not to benefit by imposing high interest rates on their members. As a member, you get to enjoy flexible loan terms thus reducing your financial load.

Secured bank loan

With some collateral, you can approach a bank for a personal loan. It is not guaranteed that your loan request will be approved. You might be given a significant amount at a very uncompetitive rate.

Things you can do to improve your FICO of 500

Any person who is not financially independent needs to improve their FICO score continuously. A difference of ten points in your score could result in your loan application being denied. You need to embrace an economic behavior that can improve on your current FICO score. The following tips can assist you I increasing your credit rating significantly.

Review your credit report regularly

As a borrower, you are encouraged to screen your credit report frequently to check whether it has any mistakes. A credit report updates you regarding your status as an account holder. You might be a victim of identity theft if someone takes credit in your name without your knowledge. It would hurt your FICO score adversely.

Clear your debts

Unless you have an emergency hat requires financing, avoid taking credit just because you qualify for them. A loan is not an asset unless you are using it to invest. It is a liability that could reduce your FICO when you are unable to service it efficiently. If possible, do away with credit cards since they encourage impulse buying. Ideally, you need to have solid repayment plan for any credit you take.

Set a payment reminder

Some creditors may not have direct access to your bank account to debit the monthly premiums automatically. It calls for you to set a reminder to let you know when your monthly payment is due. A single late payment could affect your FICO score adversely. You could sign up for the email or text notification service offered by your creditor.