Learn what it means to have a FICO of 595. Understand how it's calculated, what loans you can obtain, and how to better your FICO score

A credit score is needed for you to be able to get a loan or credit. The reason behind this is because it will help financial institutions to determine your creditworthiness. They will also see every loan that you made and the payment history that you have. Find out more about it by reading the information below.

Credit scores are calculated based on the proprietary algorithm. This will include the person's outstanding debts, payment history, and the length of the individual's credit history.

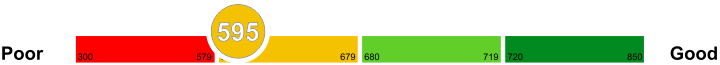

Credit scores can range from 300 to 850. The higher the individual's score, the lower the risk. People who have lower credit scores are considered high risk, which will make lending companies ask for more requirements.

About Fico scores

Fair Isaac Corporation is the one who established FICO, and it is one of the most commonly used credit scoring systems today.

According to FICO, 90% of the most reputable and respected lenders today are making decisions according to this kind of credit scoring system. Get to know more about Fico scores by reading the information below.

How FICO is calculated

Different grade scales are used around the world, but the most commonly used system is the FICO score. FICO stands for Fair Isaac Corporation, which is responsible for calculating your FICO score.

FICO has not declared any detailed explanation on how the FICO score is calculated. However, some of the important variables considered in determining your credit score are as follows:

First and foremost, your payments are considered in calculating your FICO score. It comprises for almost 35 % of your FICO score. Next, 30 % of the score is calculated by your debts. Your length of credits accounts for next 15 %, followed by the type of credit used and some inquiries made for credit hold 10 % value each in FICO scores.

Explanation of FICO ranges

If you are wondering about the explanation of FICO ranges, then reading the information below will help.

Having knowledge about the credit score is essential as this can give a huge impact on your future. Knowing your credit score will help you know the credit worthiness that you have. Here are the explanation of FICO ranges.

579 and Below

579 and below means you have a poor FICO. Lenders may require a certain amount of deposit before granting your application.

670 to 739

670 to 739 is a good FICO; wherein borrowers are considered as acceptable.

740 to 799

740 to 799 is a very good FICO; wherein borrowers can expect better interest rates.

800 and Above

800 and above is an exceptional FICO and people with this score are quickly approved of their application.

What does it mean to have a FICO of 595

A FICO score of 595 is still a bad credit. However, it is important to note that this credit can either give loans or lenders can still avoid your business. Lenders and your creditors are not only going to use your credit score history alone to determine your credit worthiness. Lenders and creditors will use other elements such as your financial flow. You might be having good credit, but plenty of debts. Therefore, even if with a credit score of 595 your financial information has a history.

Reasons for this score

Whatever made you have a credit score of 595 are diverse factors. You either have no credit history, or you have already damaged your credit to this level. Past credit problems are some of the main factors that can keep your credit so low as compared to having no credit at all. On the other hand, at 500 at least you are not at the bottom, and you can work your way upwards. When you know what made you have such poor rating, it is easy to work it upwards and repair the parts of the credit that have damaged your credit health

What you qualify for with this FICO score

Firstly, if you don't have a credit card, you only qualify for a secured credit card. If you qualify for a loan, it will come with very high-interest rates. Lenders think that they are risking delay on their borrowed money and they would want to recover the interest from late money as early as the day they give you credit. Therefore, you have a choice of being patient and working your credit as compared to wanting to find more credit which is costly. You do not need to look for credits all the time unless it is necessary.

Credit cards with a FICO of 595

Getting credit cards with a FICO of 595 can be challenging, which is why improving your score is essential.

There are different ways on how you can improve your score. A FICO of 595 is known as a poor rating, which is why they are looking for ways on how they can enhance their FICO. Below are some of the tips that you can do.

Prompt Payment

It would be best to pay your bills promptly and in full. The reason behind this is because paying late can impact your FICO negatively.

Avoiding Debt

If you have any remaining credit card debt, it would be best to pay them all off. You can get a loan and use that money to pay your debt. Once you have paid them off, it would be best to avoid closing the account as this can affect the FICO severely.

Car loans with a FICO of 595

Are you worried that your FICO of 595 won't get you the loan that you need? Then reading this useful information below is essential.

Having a bad FICO can be a challenge, but there are lending companies that are willing to grant you the loan that you need. Usually, these companies do not only check your FICO scores but other factors as well. Let's find out what these factors are below.

Income

If you have a bad FICO, then proving to the company that you are earning is essential. The reason behind this is because they need to make sure that you have the capabilities to pay for the loan that you are applying. Provide them with all the necessary income documents upon application.

Current Job

Another factor is that you need to be employed for the company to grant you your loan. You can provide them with a certificate of employment when you submit an application for your loan.

Mortgages with a FICO of 595

If you have a FICO score of 595, you will have to develop a strategy to be able to acquire credit or loan for home or mortgage need. The top-tier banks may reject your loan application. You can target the low to mid-tier banks along with the local banks. You can compare the interest rates and conditions of the loan and select the one that suits you the best.

You can ask a family member or a friend who has a higher credit score to co-sign for your loan. Co-signing increases your chances of getting the loan approval from the banks for home or mortgage. You may also get the loan offer that is better than when you apply on your own.

Home Loans with a FICO of 595

A FICO score of 595 falls in the average to a weak category on the grade scale. It is not going to be easy to get the best possible offer for your home loan. At this FICO score, most of the banks will charge higher interest rates.

Therefore, you need to have a look at other options. You should have a look at the local mortgage lenders. Their interest rates may be competitive compared to banks.

You should also ask your agent about the FHA approved lenders. You can get a loan from FHA-approved lenders with the given FICO score if you are willing to pay 10 % or higher amount of down payment.

Personal Loans with a FICO of 595

Obtaining a personal loan for your investment is not limited to banks only. A FICO score of 595 cannot be able to secure the amounts that you desire especially when your investment requires massive funding. That is why you are advised to find out additional sources that can offer you relatively cheap personal loans.

Credit unions

They have proved to be the most affordable and most convenient sources of personal loans. Loans are provided to their members at subsidized rates and flexible terms. Your repayment period can be extended if you run into difficulties since they are non-profit financiers.

Peer to peer loans

There has been an upsurge of online sites that provide personal loans to their customers. You simply lodge your loan request on their system. It is the displayed as a listing for potential investors to evaluate. An investor then offers you a loan directly if they are satisfied with the request.

Friends and family

Your relatives and friends may be aware of the financial woes you are going through. It is, therefore, easy to convince them why you need additional funding. It is crucial for you to keep your end of the bargain for future assistance from them.

Things you can do to improve your FICO of 595

Most financier institutions have now made it mandatory to run credit checks before issuing loans to their customers. Borrowers with lower FICO scores finding it hard to obtain credit, and when they do, the annual percentage rates are usually high. It is your duty as a borrower to ensure you improve and keep your FICO score higher. A higher credit rating ensures you qualify for most loan schemes and with cheaper rates of interest.

Do away with unnecessary credit cards

Financier institutions will always have a look at the credit available to you besides what you are using when vetting you. There is no reason to keep credit cards that you don't utilize. Closing unnecessary credit cards also decrease the odds of falling prey to fraudsters if you misplace them or lose them. The credit under your name has the potential of damaging your score if not paid promptly.

Pay on time

Taking credit is a voluntary action thus you don't have to wait for reminders to pay your premiums. Your repayment history contributes to a significant part of your FICO score, and timely payments will undoubtedly improve it. Timely payments show you are a responsible borrower, which boosts your credit rating.

Fixing your credit without assistance from third parties

You can seek the help of credit fixing companies, but this won't reflect well on your FICO score. It is the primary reason why you need to plan on how to finance the loan you are taking. Lenders want borrowers they can rely on to meet their financial obligations with minimal difficulty. It is why should acquaint yourself with the terms of the credit first before taking it to avoid any problems during the repayment period