Learn what it means to have a FICO of 750. Understand how it's calculated, what loans you can obtain, and how to better your FICO score

A credit score is needed for you to be able to get a loan or credit. The reason behind this is because it will help financial institutions to determine your creditworthiness. They will also see every loan that you made and the payment history that you have. Find out more about it by reading the information below.

Credit scores are calculated based on the proprietary algorithm. This will include the person's outstanding debts, payment history, and the length of the individual's credit history.

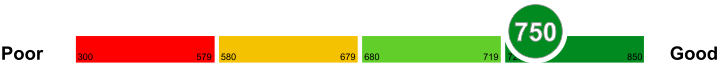

Credit scores can range from 300 to 850. The higher the individual's score, the lower the risk. People who have lower credit scores are considered high risk, which will make lending companies ask for more requirements.

About Fico scores

Fair Isaac Corporation is the one who established FICO, and it is one of the most commonly used credit scoring systems today.

According to FICO, 90% of the most reputable and respected lenders today are making decisions according to this kind of credit scoring system. Get to know more about Fico scores by reading the information below.

How FICO is calculated

Different grade scales are used around the world, but the most commonly used system is the FICO score. FICO stands for Fair Isaac Corporation, which is responsible for calculating your FICO score.

FICO has not declared any detailed explanation on how the FICO score is calculated. However, some of the important variables considered in determining your credit score are as follows:

First and foremost, your payments are considered in calculating your FICO score. It comprises for almost 35 % of your FICO score. Next, 30 % of the score is calculated by your debts. Your length of credits accounts for next 15 %, followed by the type of credit used and some inquiries made for credit hold 10 % value each in FICO scores.

Explanation of FICO ranges

If you are wondering about the explanation of FICO ranges, then reading the information below will help.

Having knowledge about the credit score is essential as this can give a huge impact on your future. Knowing your credit score will help you know the credit worthiness that you have. Here are the explanation of FICO ranges.

579 and Below

579 and below means you have a poor FICO. Lenders may require a certain amount of deposit before granting your application.

670 to 739

670 to 739 is a good FICO; wherein borrowers are considered as acceptable.

740 to 799

740 to 799 is a very good FICO; wherein borrowers can expect better interest rates.

800 and Above

800 and above is an exceptional FICO and people with this score are quickly approved of their application.

What does it mean to have a FICO of 750

At 750, lenders and your financial partners would wish that you go up to perfect score. Go for 850; you are too close and the best approach to do that when at 750 is an open door that you have. Save money and reduce liabilities and move up the ladder within a few months to enjoy financial freedom.

What is perceived a good FICO score?

Taking a review of the FICO diagram, a score of 750 is significantly a good rating. People having a FICO score beginning from 750-799 are considered as having a somewhat decent financial health. About 18% of Americans have this score. Despite the fact that it looks high on the greater part of the general population, phenomenal saving and financial information are conceived to accomplish it. To achieve this score, you need to begin early in history. Ensure you understand your financial obligation especially when it comes to credit and loan usage.

Benefiting from a FICO score of 750

The primary thing to do when you have such a high FICO rating is to attempt and explore the financial advantages that exist. With this score, you will be appealing to moneylenders, and some will try to force their way to you because they know that you're a good asset and can put their money into good usage. Along these healthy lines, it is your chance to arrange for your credits and can anticipate great interests.

Building your score to 750

There are a few cases where you may have developed from lower FICO rating to the higher level. However, you cannot do things like buying a home with a FICO rating under 600. You can only do this if you have 750 and above. Knowing that there is nothing good below 600, develop the best attitude to work your way up the ladder so that you can benefit from the best financial goodies that other people with a much healthy credit enjoy. A high FICO score rating is good news that will assist you to save a significant amount of money.

Credit cards with a FICO of 750

Applying for credit cards with a FICO of 750 is easier because of this FICO is categorized as a good score.

Credit cards nowadays come with different rewards and benefits. This is the reason why knowing the best that you can have is essential. If you are into earning bonuses, then these cards below are perfect for you.

Susan G. Komen

Susan G. Komen credit card will let you earn USD 100 online cash after spending USD 500 on purchases. You can also earn 1 to 2% cash backs on purchases. It has no annual fee and has an APR of 3%.

Hilton Honors from American Express

Hilton Honors will let you earn bonus points of 50,000 after spending USD 750 on purchases. They offer 7x Hilton points on purchases within Hilton Portfolio. It also has no annual fee, while the regular APR is 15.49%.

Car loans with a FICO of 750

People who are getting car loans with a FICO of 750 won't surely have a hard time getting their applications approved since this is known as an excellent score.

A FICO of 750 is characterized as a score that is excellent. Most financing companies offer them loans with low-interest rates, which is beneficial to them. Here are some of the companies who can provide you with the best interest and terms that you need.

US Bank National Association

US Bank National Association is one of the financing companies that can provide you with the loan that you need. The good thing about them is that they don't require their applicants to give down payments, and they give same day decisions.

Bankrate

Bankrate is offering auto loans for people with a FICO of 750. They also have different terms, from 36 months to 60 months. They also have competitive rates with the other big auto loan companies today.

Mortgages with a FICO of 750

If you have a FICO score of 750, you are in the ?very good' category on the grade scale. You can use your strong FICO score to get the best interest rates on your home loan or mortgage credit.

You can start with the banks and lending institutions to lend you credit pay for your home or mortgage needs. There will be a number of offers with different conditions associated with them. You can select the offers that suit your financial position the best.

You can also apply for government loans. Government loans for new homes and mortgage are common in today's industry. Their major advantage lies in their lower interest rates and manageable and flexible terms and conditions.

Home Loans with a FICO of 750

If you have a FICO score of 750, your score is considered good or above average. This means that you can search for various options for home loans available with banks, firms and other financial institutions. First, you should go to the banking sector and ask for the most relevant home loan offers available at times.

Secondly, you should look for any government home loan options. The loans that are offered by government are easier to manage and more flexible compared to commercial bank loan options.

With a score of 750, you won't be required to pay higher interest rates or down payments compared to borrowers that have lower FICO scores.

Personal Loans with a FICO of 750

As your FICO score increases, more personal loan avenues open for you. Higher FICO scores indicate financial maturity and the power of an individual to service their loan. You can easily obtain a personal loan from a bank or other secondary financial institutions. The terms are relatively friendly, and you get competitive rates.

Bank loans

You are eligible for secured and unsecured loans. The type of loan you are given depends on the amount you are applying for and your ability to repay. If you have a steady, high income, you are eligible for unsecured loans. Unsecured loans don't require any collateral to be issued. On the other hand, when your income is unstable and lower, you can still get a secured loan.

Non-bank loans

These are secondary financiers such as credit unions, peer to peer lenders, pawnbrokers, or even friends and family. Even though the amounts you can access from them are limited, their terms are usually friendly and can be renegotiated. It is because the loan is given directly to you and you have a close interaction with them.

Things you can do to improve your FICO of 750

Raising the FICO score is a prerogative for any borrower wishing to access affordable credit facilities. Lenders will also give priority to individuals with a higher credit rating because they have exhibited some sense of financial maturity. Fortunately for you, there are numerous ways in which you can improve your FICO score towards the excellent category.

Ask for grace from your creditor

At times, even the most fool-proof arrangement encounters challenges. You may be late with one payment due to unforeseen circumstances, which could damage your FICO score. If you have been making timely payments, you can approach you creditor and ask them to remove the late item from your credit file. It is only applicable for individuals with a credible reason and meeting their financial obligations efficiently.

Scrutinize your credit report

Mistakes in the credit report affect even those with an excellent FICO score. Don't take the free credit reports for granted; they are issued to you for confirmation. A single error can reduce your FICO score significantly.

Pay your debts

Any debt you accumulate is undoubtedly going to take a bite of your FICO score. Therefore, paying your debts is necessary with a priority to those with higher rates of interest. Credit is a liability that damages your rating, and should be gotten rid of as soon as possible.