Learn what it means to have a FICO of 800. Understand how it's calculated, what loans you can obtain, and how to better your FICO score

A credit score is needed for you to be able to get a loan or credit. The reason behind this is because it will help financial institutions to determine your creditworthiness. They will also see every loan that you made and the payment history that you have. Find out more about it by reading the information below.

Credit scores are calculated based on the proprietary algorithm. This will include the person's outstanding debts, payment history, and the length of the individual's credit history.

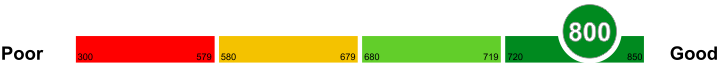

Credit scores can range from 300 to 850. The higher the individual's score, the lower the risk. People who have lower credit scores are considered high risk, which will make lending companies ask for more requirements.

About Fico scores

Fair Isaac Corporation is the one who established FICO, and it is one of the most commonly used credit scoring systems today.

According to FICO, 90% of the most reputable and respected lenders today are making decisions according to this kind of credit scoring system. Get to know more about Fico scores by reading the information below.

How FICO is calculated

Different grade scales are used around the world, but the most commonly used system is the FICO score. FICO stands for Fair Isaac Corporation, which is responsible for calculating your FICO score.

FICO has not declared any detailed explanation on how the FICO score is calculated. However, some of the important variables considered in determining your credit score are as follows:

First and foremost, your payments are considered in calculating your FICO score. It comprises for almost 35 % of your FICO score. Next, 30 % of the score is calculated by your debts. Your length of credits accounts for next 15 %, followed by the type of credit used and some inquiries made for credit hold 10 % value each in FICO scores.

Explanation of FICO ranges

If you are wondering about the explanation of FICO ranges, then reading the information below will help.

Having knowledge about the credit score is essential as this can give a huge impact on your future. Knowing your credit score will help you know the credit worthiness that you have. Here are the explanation of FICO ranges.

579 and Below

579 and below means you have a poor FICO. Lenders may require a certain amount of deposit before granting your application.

670 to 739

670 to 739 is a good FICO; wherein borrowers are considered as acceptable.

740 to 799

740 to 799 is a very good FICO; wherein borrowers can expect better interest rates.

800 and Above

800 and above is an exceptional FICO and people with this score are quickly approved of their application.

What does it mean to have a FICO of 800

Despite the fact that you have to do numerous things with a FICO score of 800, you're one more score to reach the financial freedom you've desired for so long. Work hard to stay at the top because 850 is also as good life because of financial freedom.

A good FICO score

A FICO Score and credit rating of 800 is a good financial rating. This rating is exceptionally healthy for all parts of your budgetary life. At 800, you're advancing your perfect credit health or score. For many people, this credit score is a dream, but there are people who are enjoying their financial freedom with this credit. A FICO score of 800 comes with good financial freedom. Individuals at this level can borrow loans that come with a fair interest pricing. Lenders and credit facilities are likely to advertise their services to you. When they do this, your work as a borrower is to find the perfect terms and conditions that will guarantee saving money. You have the opportunity to utilize your hard work and success because you have tried to save money for a lengthy time.

Is it possible to attain it?

Achieving a FICO rating of 800 is possible. Achieving this score will walk you to 850, and that means having a perfect financial credit. However, bear in mind that you're not going to get a credit score of 800 overnight. Making it to 800 cannot happen overnight. You need a long run of financial saving strategies to achieve a score required for your financial freedom.

Using your 800 FICO score

At 800, you're nearing the perfect credit score. At this point, you have the obligations to save money instead of spending. You have the opportunity as well as the resources to do this. When creditors come to you, use the opportunity to bargain your interest and repayment terms and conditions and in the process save money instead of spending. You have worked hard, and you need your financial freedom, and this is the time for it.

Credit cards with a FICO of 800

It is easier to get a credit card if your FICO is 800 since this is known as an excellent score.

People nowadays are wondering on what the available credit cards that they can avail with their FICO of 800. There may be a lot to choose from, but choosing the ones where you can get numerous benefits is essential. Below are some of the best credit cards to have.

US Bank Business Edge Platinum

US Bank Business Edge Platinum is offering a 0% APR and balance transfers for the first year. They don't have an annual fee which is a good thing. It also has protection; wherein it will protect you against transactions that are unauthorized.

Points Visa

Points Visa will let you earn 5 points for every USD 1 spent on purchases. They also offer rewards, including gift cards, electronicredit score, merchandise and more. They have a zero annual fee and an APR of 10.99% to 19.99%.

Car loans with a FICO of 800

Getting car loans with a FICO of 800 is easy because they have already built up their scores well.

Typically, people with a FICO of 800 took years to built up their scores. If you are wondering on how they can achieve a rating like this, then knowing the things that you can do is essential.

Paying On Time

The best way to earn a FICO of 800 is to make sure that you are paying all your bills on time. Your debts should also be paid promptly as this will also reflect on your FICO. Settling all your debts will help you increase your FICO in time.

Credit Cards

It would be best to avoid getting credit cards so that you can increase your FICO. It is also best to get rid of the cards that you are not using, as this can only lower your score.

Mortgages with a FICO of 800

This shows that there is a very small amount of risk or no risk at lending you the credit. Therefore, most of the banks and lending institutions will be willing to lend you money for a home loan or mortgage needs.

You can look for the best loan options available in the market. Go to renowned banks and state your need. They will be able to give you different offers; you should look to find one that suits your financial situation the best.

You can also apply for government sponsored loan plan and offers. You should also have a look at the premium offers on credit cards for the people that have high FICO scores.

Home Loans with a FICO of 800

With a FICO score of 800, you are going to enjoy a number of benefits. First, you will get your loan request approved quickly. Secondly, you might be paying the lowest interest rates on your credit. Therefore, you can go to the banks that offer the best home loan options. You won't be asked to deposit high percentage of down payment for your loans.

Moreover, if you have a FICO score of 800, you virtually get the best credit card offers and options. Therefore, if you do not like the options provided by the banks for your home loan, you can simply get credit from your credit card.

Personal Loans with a FICO of 800

A FICO score of 800 and above is perceived as excellent by lenders. It means you can pay your debts comfortably. Most banks would fight to be your financial partner since you guarantee them profits through the interest that you pay. Technically, you have access to all types of personal loans.

Home equity loan

In case you want a top-up on your current credit, your home can serve as collateral for the loan. This is applicable when you are applying for significant amounts with a longer repayment period. You may be in a position to choose terms that are favorable to you and the financier.

Unsecured loan

Your ability to repay the loan is not in question. You only have to assure the bank of your repayment plan. You can take a significant amount as long as it doesn't end up choking your financially.

Credit union

It is much easier for you to convince a credit union to lend you some money courtesy o your excellent rating. You won't find any difficulties in paying back since the interest rate by credit unions is usually low.

Things you can do to improve your FICO of 800

It is the dream of everyone to attain a perfect FICO score to qualify for the lowest annual percentage rates. It takes a high level of financial maturity and discipline to achieve it. At 800 and above, you can walk into any financial institution and come out with a loan of your choice. However, the ease of having your credit application approved comes with a high risk. You need to stay alerted to improve it to 850.

Pay your bills on time

Late payments are the most common negative items that appear on the credit files of most borrowers. There is no alternative to meeting your financial obligations if you intend to maintain or improve on your excellent FICO score. It is recommended to pay the minimum monthly premium before the due date, especially if you are servicing a mortgage.

Dispute errors in your credit report

Some people never take their time to review their credit reports, which may contain mistakes at times. Any misreporting is bound to affect your FICO score negatively. It is your right and responsibility to obtain a free annual credit report from the three primary credit agencies to identify any errors in it. You can correct the mistakes by writing directly to your creditors and the credit bureaus.

Cut ties with bad credit partners

Nothing hurts like when you work hard to improve your FICO score only to be dragged down by the poor rating of your partner. Ensure you close or exit the joint accounts you hold with your wife, husband, or business partner once you have separated because their poor score reflects on your credit report.