Follow the tips below on how you can improve your credit score.

Find out how to improve credit score in South Africa by reading the information below.

A lot of people are asking the same question, what is my credit score in South Africa. This is, of course, a good thing because they can have the chance to improve their scores. If you are wondering on how to improve credit score in South Africa, then reading the information below is essential.

Avoid Too Much Debt

It would be best to avoid acquiring too much debt, which you can hardly pay anymore. If you are striving to pay one debt, avoid adding in another one, as this will only lower your credit score. Avoid using 1/3 of your overall income to pay your debts.

Avoid Creditors

If you have unpaid bills, creditors will start contacting you. You need to make sure not to let this happen by paying your bills on time. But if you really can't pay them on time, you can start contacting them instead and negotiate arrangements.

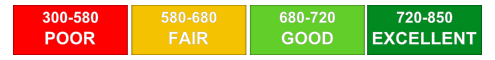

If you are asking as what is a good credit score in South Africa, the answer is easy. Anything that is above 650 is considered as a good rating.

What is a credit score in South Africa

Get to know more about the credit score system in South Africa by reading the information below.

There are a lot of ways on how you can monitor your credit score in South Africa, for you to be able to know where you stand when applying for a loan or credit. Below are the two most trusted financial companies where you can monitor your credit score easily.

TransUnion

TransUnion offers different benefits for their members. This, of course, includes unlimited access to the credit score under the TransUnion. They also offer a 24-month view on your accounts, where you can change your payment habits.

Experian

Experian also offers different benefits, such as credit advice for its consumers and solutions on credit management. You can also monitor your credit score on their website, which is beneficial for you.

How are credit scores calculated in South Africa

In South Africa, the consumer as well as commercial credit information. This score is calculated by using various factors. Higher the score, lower is the risk of lending to the client. Most of the credit score models range from 300 to 1000.

One of the most important variable in calculating the credit score is your payment history. It shows whether you have paid your obligation on time or not. The total length of time that you have held credit also plays a significant role in your credit score. Another important variable that is used for calculating the credit score is the number of applications you have made for acquiring loans. It shows your need or desperation for a loan.

All of the variable mentioned above along with some other data from your credit report is gathered to give you a credit score.

Explanation of credit score ranges in South Africa

The credit score in South Africa is usually from 330 to 850. Get to know the explanation of credit score ranges by reading the information below.

Your credit score will highly depend on the history that you have when it comes to handling your finances. Some people tend to forget that knowing their credit score is essential, for them to get updated. Here are some of the information that you need to know about credit score.

Poor to Sub-Prime

A poor credit score ranges from 619 and below, while a sub-prime is from 620 to 679. Getting loans and applying for credit cards may be difficult because of the small credit score. Interest rates may be high as well with people with this credit score.

Good to Excellent

A good credit score ranges from 720 to 749, while an excellent one is 750 and above. Lenders easily grant loans to people with this credit score because they are considered as low risk.

Things you can do to improve your credit score

Having a bad credit score is similar to having poor health. Therefore, you need to take measures that ensure you are continually improving on it. The most efficient way of repairing bad credit is good management over time. Improving your credit score is necessary for you to be eligible for better terms and rates for loans in the future.

Regular credit report checks

You are advised to monitor your credit report regularly to see if it has any errors. A credit report brings you up to speed on your status as a debtor. Ensure that the payments are reported correctly and the amount owed to each creditor is correct. Errors must be disputed to your credit bureau promptly.

Reduce your debt

Most people usually take loans just because they are eligible for them without considering the potential damage to their credit score. For a start, you can reduce your reliance on credit cards. Design a plan that ensures you give priority to your debts that have the highest interest rates.

Payment reminders

If your monthly premium is not automatically debited from your account, you need to set up a payment reminder. Timely credit repayment improves your credit score over time. Some financiers usually send emails or texts to their clients to make payments.