You should understand how your credit score is determined using either the Beacon 5 credit score model or other crediting rating models.

The Equifax 2004 scoring model is the most commonly used and also referred to as the Beacon 5 credit score. This model used by almost all lenders including mortgage providers. However, recent times have seen creditors upgrading to the 2008 models. Beacon is registered as a trademark by Equifax.

Score range

The Beacon 5 credit score from Equifax starts from 280 to 850. Just like other credit rating models, having a lower Beacon 5 credit score can deny you access to cheaper loans since you have to pay high-interest rates, and you are not eligible for major purchases.

Determining your score

Several factors with different weights in the algorithm are considered when calculating your Beacon 5 credit score. The amounts owed and payment history determines about two-thirds of your score. Your payment history contributes 35% while the amount owed accounts for 30%. Other factors like credit history account for 5-7%, the amount of new credit applied for provides 10-% while the varieties of credit utilized account for about 15% of your score.

Personal data not included

The Beacon 5 credit score model does not consider any personal details that are not associated with credit when determining your rating. Some of these factors include age, race, religion, national origin, color, and marital status. You residence employment details such as occupation and salary are not included either. Inquiries like insurance, account review, and request for your credit report are not considered. Information that is not contained in your credit file cannot be used.

Factors that can damage your Beacon 5 credit score

Some factors can substantially dent your rating if not taken care of. They include serious issues like high levels of credit default on accounts or a large proportion of credit consumption to total credit available. Other minor factors include opening too many credit lines and possession of multiple active credit cards.

What is a credit score

A credit score is needed for you to be able to get a loan or credit. The reason behind this is because it will help financial institutions to determine your creditworthiness. They will also see every loan that you made and the payment history that you have. Find out more about it by reading the information below.

Credit scores are calculated based on the proprietary algorithm. This will include the person's outstanding debts, payment history, and the length of the individual's credit history.

Credit scores can range from 300 to 850. The higher the individual's score, the lower the risk. People who have lower credit scores are considered high risk, which will make lending companies ask for more requirements.

About Fico scores

Fair Isaac Corporation is the one who established FICO, and it is one of the most commonly used credit scoring systems today.

According to FICO, 90% of the most reputable and respected lenders today are making decisions according to this kind of credit scoring system. Get to know more about Fico scores by reading the information below.

How are credit scores calculated?

The weight of each of the five categories are; 30% of amount owned, 10% is for the new credit, 15% accounts for the length of credit history, 10% is the credit mix and the last 35% accounts for the person's payment history.

The FICO score takes into consideration positive as well as negative aspects of the credit report. The percentage or the weight of any of the categories mentioned above may differ from a person to another depending upon the information available in the credit report.

The FICO score takes all of the information from your credit report. However, the banks or any other lending institution might look at your income, type of credit and employment history when you apply for a loan or mortgage.

Once a certain lender asks for a client's credit report, they can also ask for the Fico score. Other sources say that your Fico score will include 35% of your payment history, 30% of your credit utilization, and 15% as to how long have you been borrowing.

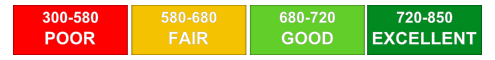

Explanation of credit score ranges

It is important to know the category that you fall into when it comes to credit score for you to be aware. The range of a credit score can go from 300 to 850. Always remember that the higher your score, the higher the chances of you to qualify for a loan. There will also be instances where a financing company is okay with 650 scores, while the other is fine with a 750 score. It will all depend on the lender itself.

A lender or a bank will check your credit score if you qualify for the application that you are requesting. Here are some of the credit score ranges that you should know.

Bad credit score

People with a credit score below 579 is known as high risks. Foreclosures, poor payment history, and bankruptcies are the reasons why people fall into this category.

Good credit score

A good credit score ranges from 680 to 719. People with this credit score can expect approvals and interest rates that are better.

Very Good

A very good credit score ranges from 720 to 799. People with this credit score is known to be small risks, and they often get loan amounts that are higher than usual.

Excellent

An excellent score ranges from 800 and above. Financial freedom is expected to people with this score.

Things you can do to improve your credit score

Having a bad credit score is similar to having poor health. Therefore, you need to take measures that ensure you are continually improving on it. The most efficient way of repairing bad credit is good management over time. Improving your credit score is necessary for you to be eligible for better terms and rates for loans in the future.

Regular credit report checks

You are advised to monitor your credit report regularly to see if it has any errors. A credit report brings you up to speed on your status as a debtor. Ensure that the payments are reported correctly and the amount owed to each creditor is correct. Errors must be disputed to your credit bureau promptly.

Reduce your debt

Most people usually take loans just because they are eligible for them without considering the potential damage to their credit score. For a start, you can reduce your reliance on credit cards. Design a plan that ensures you give priority to your debts that have the highest interest rates.

Payment reminders

If your monthly premium is not automatically debited from your account, you need to set up a payment reminder. Timely credit repayment improves your credit score over time. Some financiers usually send emails or texts to their clients to make payments.