Find out the information on how a credit score is calculated in India.

Are you wondering on how a credit score is calculated in India? Then the information below will give you an idea.

Having the right CIBIL is essential for your credit card or loan application to get approved. But you may be wondering about how a credit score is calculated in India, if so then reading the information below will surely give you the answers that you are looking for.

TransUnion Score

For people who don't know, CIBIL will be the one to calculate a person credit score using advanced analyticredit score. The closer your score to 900, the confident the credit company that you can repay your loan.

How Your Score is Calculated

The score is calculated based on the behavior of the individual when it comes to paying loans. Your TransUnion score, on the other hand, is calculated based on the "Enquiry" and "Accounts" information that you have.

Factors Affecting the Calculation

The credit utilization is one of the factors that affect the calculation. The account's delinquency will also be included and as well as the trade attributes of the person's credit lines.

What is a credit score in India

Familiarize yourself with a credit scores in India by reading the information below.

CIBIL is India's credit information company, which collects and maintain all the information on an individual's credit card and loan. Find out more about credit score in India below.

Credit Score Range

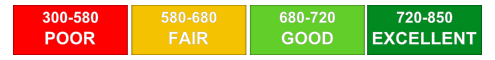

The credit score ranges from 300 to 900, wherein the closer your score is to 900, the more confident the lending company is with you when it comes to granting you your loans. If your score is less than 750, most lending companies will see you as high risk, which can lessen your chances of getting approved.

Benefits of Having Good CIBIL

There are a lot of advantages of having good CIBIL, such as getting a higher amount of your loan, lower interest rate, and a fast approval of the loan. Some companies will also give you a longer repayment period, which means lower monthly dues for you.

How are credit scores calculated in India

In India, credit score is calculated by Credit Information Bureau of India Limited (CIBIL) which first started collecting borrower's information. It is also known as the CIBIL TransUnion score which is measured in a range of 300 to 900. Closest to 900 shows better creditworthiness and little probability of the creditor defaulting on his or her payments.

The CIBIL TransUnion score is based on five factors. First, is the applicant's repayment history which accounts for 35 % of the total score. Second is the credit balance which accounts for 30 % of the credit score in India. Followed by the amount of time for credit use which is responsible for 15 % of the rating on your CIBIL score. Final 10 % is for your overall credit mix.

The CIBIL score that is calculated using the weights mentioned above is responsible for approval, disapproval or the type of credit when you apply for loans in India.

Explanation of credit score ranges in India

A lot of people are wondering about the explanation of credit score ranges in India. Let's find out by reading the information below.

The credit score in India ranges from 300 to 900. The higher your score, the easier it is for credit companies to trust you. You can easily get a loan or a credit card without providing too many requirements.

A Good credit score

A good credit score ranges from 750 to 900 and most banks and financial institutions see people who have this score as low risk. This means that they are comfortable in approving credit card or loan applications to these people.

A Bad credit score

A bad credit score ranges from 300 to 749 and banks and financial institutions see people who have this score as high risk. They usually require more requirements before granting them their applications.