You don't want to go below excellent credit score rating. Know that credit card money is not free money. You are taking out a loan. In fact, a huge interest loan for that matter. It is important to pay attention to the fine print of your credit card usage.

Excellent credit in Canada begins at 760 and above. According to EQUIFAX credit score rating, individuals with a credit score of 760-900 are considered as having an excellent credit score rating. Approximately 57% of Canadians have this score. An excellent score is viewed as favorable credit rating to financiers and creditors.

What you can get with excellent credit

An excellent credit score in Canada is favorable for good loans and good credits. With an excellent credit, banks and financial institutions pre-approves you for a given amount even without making any applications. An excellent credit will get you an unsecured line of credits because of you credit your investment and collateral property. The difference between an unsecured and a secured line of credit is the interest charges.

Wider lines of credit

The line of credits can be useful when you have irregular, but an ongoing need for a loan. Also, an excellent credit means that you are eligible for mortgages. Canadians with excellent credit score use this opportunity as properly because financiers view these people as having commitments of long-term investment hence worth the credit or loan they need.

Taking advantage of the opportunity

In Canada and anywhere in the world, excellent credit is an opportunity to tap into. You will get credit cards that will make your financial life convenient. However, you are advised to use your credit properly. Otherwise, poor usage of this card can land you into trouble.

What is a credit score in Canada

If you are one of the many people who is asking about what is a credit score Canada, then you definitely should read the information below.

It is always important to monitor your credit score for you to know where you stand when it comes to lending companies. Fortunately, you can now check your credit score for free with the use of Borrowell because they have partnered with Equifax Canada. Get to know more about these two companies by reading the information below.

Borrowell

Borrowell is a fintech lender company in Canada which offers fast, friendly, and fair loans to people who need it the most. They have fix interest rates that are affordable.

Equifax Canada

Equifax gathers credit reports, which include your payment history, your debts, and the length of the credit that you already have. They have grown from a credit consumer company to a leading provider of credit score around the globe.

How are credit scores calculated in Canada?

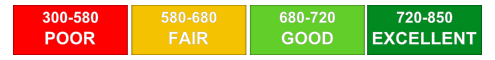

In Canada, credit scores are calculated to show your creditworthiness which is useful for the lending institutions to identify the level of risk involved in lending you loans such as mortgage or home loans. The credit score ranges from 300 to 850. Higher the score, better are chances of you repaying your loans and hence, lower the risk for the lenders.

The credit score is determined by giving your payment history the 35 % weight. Followed by, the amount you already owe as 30%. The weight of 15% is given to the length of your credit history. The new credit applications that you have made and the type of credit that you have used in the past account for 10 % each.

Explanation of credit score ranges in Canada

Knowing the explanation of credit score ranges in Canada is essential for you to understand them fully well.

Getting your loan or credit card approved will depend highly on your credit score. Not everyone is familiar with the ranges of credit score in Canada, which is why familiarizing yourself with them is important. Below are the credit score ranges that you need to know.

Poor

Poor credit score ranges from 300 to 559. According to a study, almost 4% of the population in Canada has this score. This can cause difficulties when applying for loans and credit cards.

Good

Good credit score ranges from 660 to 724. 15% of the population has this score. This credit score can help you to obtain a loan or a credit card but with added requirements.

Excellent

An excellent score ranges from 750 and above. 57% of the population has this score. They can quickly obtain every loan or credit card that they need without providing requirements.

Things you can do to improve your credit score

Having a bad credit score is similar to having poor health. Therefore, you need to take measures that ensure you are continually improving on it. The most efficient way of repairing bad credit is good management over time. Improving your credit score is necessary for you to be eligible for better terms and rates for loans in the future.

Regular credit report checks

You are advised to monitor your credit report regularly to see if it has any errors. A credit report brings you up to speed on your status as a debtor. Ensure that the payments are reported correctly and the amount owed to each creditor is correct. Errors must be disputed to your credit bureau promptly.

Reduce your debt

Most people usually take loans just because they are eligible for them without considering the potential damage to their credit score. For a start, you can reduce your reliance on credit cards. Design a plan that ensures you give priority to your debts that have the highest interest rates.

Payment reminders

If your monthly premium is not automatically debited from your account, you need to set up a payment reminder. Timely credit repayment improves your credit score over time. Some financiers usually send emails or texts to their clients to make payments.