You can improve your credit score fast in Canada by embracing sound financial practices. Credit should only be taken for meaningful use, and not for leisure.

To access cheap loans with flexible terms, you need to have an excellent credit rating. Therefore, it is necessary for you to improve your credit score fast. At times, we all need financial support from lenders and the efficiency of getting depends on how good your credit score. Some lenders in Canada may ignore you if your rating is low and you are not doing anything to improve it.

Pay bills on time

You are responsible for any credit you take thus the need to make timely payments. If you delay or forfeit your premiums, the lender may report you to credit agencies. Punctual payments also increase the trust between the borrower and the lender, which is reflected in an improved credit score. You don't want to damage your rating just because of late payments.

Monitor your credit limit

You are advised not to exceed the credit limit set for you on your credit card. The ratio of the amount of credit you use versus the revolving credit contributes to your credit rating. It is encouraged to keep the ratio below 30% to ensure continuous improvement of your score.

Reduce credit card application and use

When you apply for a new credit card, a hard pull is conducted on your credit score which has a negative impact. Your credit score risks damage when too many credit companies make requests about credit status within a short time. You can, however, request for your report since there is no impact on your score.

What is a credit score in Canada

If you are one of the many people who is asking about what is a credit score Canada, then you definitely should read the information below.

It is always important to monitor your credit score for you to know where you stand when it comes to lending companies. Fortunately, you can now check your credit score for free with the use of Borrowell because they have partnered with Equifax Canada. Get to know more about these two companies by reading the information below.

Borrowell

Borrowell is a fintech lender company in Canada which offers fast, friendly, and fair loans to people who need it the most. They have fix interest rates that are affordable.

Equifax Canada

Equifax gathers credit reports, which include your payment history, your debts, and the length of the credit that you already have. They have grown from a credit consumer company to a leading provider of credit score around the globe.

How are credit scores calculated in Canada?

In Canada, credit scores are calculated to show your creditworthiness which is useful for the lending institutions to identify the level of risk involved in lending you loans such as mortgage or home loans. The credit score ranges from 300 to 850. Higher the score, better are chances of you repaying your loans and hence, lower the risk for the lenders.

The credit score is determined by giving your payment history the 35 % weight. Followed by, the amount you already owe as 30%. The weight of 15% is given to the length of your credit history. The new credit applications that you have made and the type of credit that you have used in the past account for 10 % each.

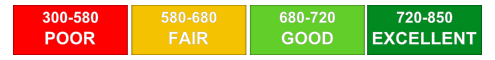

Explanation of credit score ranges in Canada

Knowing the explanation of credit score ranges in Canada is essential for you to understand them fully well.

Getting your loan or credit card approved will depend highly on your credit score. Not everyone is familiar with the ranges of credit score in Canada, which is why familiarizing yourself with them is important. Below are the credit score ranges that you need to know.

Poor

Poor credit score ranges from 300 to 559. According to a study, almost 4% of the population in Canada has this score. This can cause difficulties when applying for loans and credit cards.

Good

Good credit score ranges from 660 to 724. 15% of the population has this score. This credit score can help you to obtain a loan or a credit card but with added requirements.

Excellent

An excellent score ranges from 750 and above. 57% of the population has this score. They can quickly obtain every loan or credit card that they need without providing requirements.