It is easier to destroy your credit score than improve it, especially if you are financially careless. You should take precautions to avoid mistakes that harm your rating.

Some financial practices add no value to your credit score. A damaged credit rating narrows the options for you to obtain loans. The rate of interest you will be charged is also determined by your credit score. The following things can destroy your credit score.

Late Payments

Your payment history contributes to about 35% of your credit score. Several late payments on your student loans, mortgages, credit cards and other utilities brings down your credit rating significant if you are reported to a credit reference bureau. Defaulting or failure to honor your financial obligations damages your score massively. It means that you cannot be trusted with credit since you have no credible payment plan. Filing bankruptcy is worse because it indicates a borrower who doesn't use available funds responsibly.

Accumulating large balances

A huge balance on your credit card means your credit utilization ratio is high. Your rating can be affected even if you manage to pay off the balance since the ratio is determined through the use of the balance on your bill at the end of every month. You are advised to maintain a credit utilization ratio of 30% or lower. Opening multiple credit accounts. Opening several credit lines at the same time shows that you are no financially prudent. You run a risk of overextending your credit and fail to pay. Avoid applying for credit if you don't need it urgently.

Closing credit cards

You must plan for the future and avoid taking multiple credit cards that you don't need for long. When you close a credit card, the available credit available to you is reduced. Consequently your credit utilization ratio increases, which reduces your credit score significantly. Co-signing for individuals with poor credit. The poor credit behavior exhibited by people you co-sign for reflects on your credit report. The co-signer takes equal responsibility for any credit received thus late payments and defaults get reflected on your credit file.

Failure to dispute errors

If your credit report contains mistakes and they are not promptly corrected, you credit rating gets damaged. You are entitled to a free report annually from your credit bureau, which provides you an opportunity to identify errors and get them rectified.

What is a credit score

A credit score is needed for you to be able to get a loan or credit. The reason behind this is because it will help financial institutions to determine your creditworthiness. They will also see every loan that you made and the payment history that you have. Find out more about it by reading the information below.

Credit scores are calculated based on the proprietary algorithm. This will include the person's outstanding debts, payment history, and the length of the individual's credit history.

Credit scores can range from 300 to 850. The higher the individual's score, the lower the risk. People who have lower credit scores are considered high risk, which will make lending companies ask for more requirements.

About Fico scores

Fair Isaac Corporation is the one who established FICO, and it is one of the most commonly used credit scoring systems today.

According to FICO, 90% of the most reputable and respected lenders today are making decisions according to this kind of credit scoring system. Get to know more about Fico scores by reading the information below.

How are credit scores calculated?

The weight of each of the five categories are; 30% of amount owned, 10% is for the new credit, 15% accounts for the length of credit history, 10% is the credit mix and the last 35% accounts for the person's payment history.

The FICO score takes into consideration positive as well as negative aspects of the credit report. The percentage or the weight of any of the categories mentioned above may differ from a person to another depending upon the information available in the credit report.

The FICO score takes all of the information from your credit report. However, the banks or any other lending institution might look at your income, type of credit and employment history when you apply for a loan or mortgage.

Once a certain lender asks for a client's credit report, they can also ask for the Fico score. Other sources say that your Fico score will include 35% of your payment history, 30% of your credit utilization, and 15% as to how long have you been borrowing.

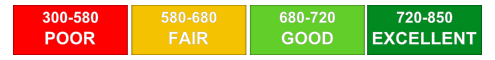

Explanation of credit score ranges

It is important to know the category that you fall into when it comes to credit score for you to be aware. The range of a credit score can go from 300 to 850. Always remember that the higher your score, the higher the chances of you to qualify for a loan. There will also be instances where a financing company is okay with 650 scores, while the other is fine with a 750 score. It will all depend on the lender itself.

A lender or a bank will check your credit score if you qualify for the application that you are requesting. Here are some of the credit score ranges that you should know.

Bad credit score

People with a credit score below 579 is known as high risks. Foreclosures, poor payment history, and bankruptcies are the reasons why people fall into this category.

Good credit score

A good credit score ranges from 680 to 719. People with this credit score can expect approvals and interest rates that are better.

Very Good

A very good credit score ranges from 720 to 799. People with this credit score is known to be small risks, and they often get loan amounts that are higher than usual.

Excellent

An excellent score ranges from 800 and above. Financial freedom is expected to people with this score.

Other things you can do to improve your credit score

The credit score ranges from 300 (the lowest credit score possible) to as high as 850 (the highest credit score possible). Higher you credit score, greater are your chances of getting your loan or credit request accepted quickly.

However, if you are facing issues with your low credit score, following are some of the tips or techniques that you can use to improve your credit score:

You should start by minimizing your total debt. The increase in your total debt value is going to affect your credit score negatively.

You should also be very careful with your bills and other credit payments. If you pay them on time, this will gradually improve your credit score.

Have a closer look at your credit balances. You do not want to cross the credit limits because they deteriorate your credit score.