Understand the meaning of having a credit score above 500, how it's calculated, what loans you can get, and how to improve your score

A credit score is needed for you to be able to get a loan or credit. The reason behind this is because it will help financial institutions to determine your creditworthiness. They will also see every loan that you made and the payment history that you have. Find out more about it by reading the information below.

Credit scores are calculated based on the proprietary algorithm. This will include the person's outstanding debts, payment history, and the length of the individual's credit history.

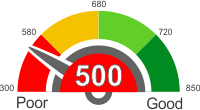

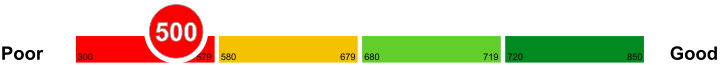

Credit scores can range from 300 to 850. The higher the individual's score, the lower the risk. People who have lower credit scores are considered high risk, which will make lending companies ask for more requirements.

About Fico scores

Fair Isaac Corporation is the one who established FICO, and it is one of the most commonly used credit scoring systems today.

According to FICO, 90% of the most reputable and respected lenders today are making decisions according to this kind of credit scoring system. Get to know more about Fico scores by reading the information below.

How are credit scores calculated?

The weight of each of the five categories are; 30% of amount owned, 10% is for the new credit, 15% accounts for the length of credit history, 10% is the credit mix and the last 35% accounts for the person's payment history.

The FICO score takes into consideration positive as well as negative aspects of the credit report. The percentage or the weight of any of the categories mentioned above may differ from a person to another depending upon the information available in the credit report.

The FICO score takes all of the information from your credit report. However, the banks or any other lending institution might look at your income, type of credit and employment history when you apply for a loan or mortgage.

Once a certain lender asks for a client's credit report, they can also ask for the Fico score. Other sources say that your Fico score will include 35% of your payment history, 30% of your credit utilization, and 15% as to how long have you been borrowing.

Explanation of credit score ranges

It is important to know the category that you fall into when it comes to credit score for you to be aware. The range of a credit score can go from 300 to 850. Always remember that the higher your score, the higher the chances of you to qualify for a loan. There will also be instances where a financing company is okay with 650 scores, while the other is fine with a 750 score. It will all depend on the lender itself.

A lender or a bank will check your credit score if you qualify for the application that you are requesting. Here are some of the credit score ranges that you should know.

Bad credit score

People with a credit score below 579 is known as high risks. Foreclosures, poor payment history, and bankruptcies are the reasons why people fall into this category.

Good credit score

A good credit score ranges from 680 to 719. People with this credit score can expect approvals and interest rates that are better.

Very Good

A very good credit score ranges from 720 to 799. People with this credit score is known to be small risks, and they often get loan amounts that are higher than usual.

Excellent

An excellent score ranges from 800 and above. Financial freedom is expected to people with this score.

What does it mean to have a credit score over 500

So what does it mean to have a credit score over 500 but under 550? Read the information below, especially if you are going to get a credit card.

Getting a credit card can be challenging especially for people who have a credit score over 500 but under 550. Here are some tips on how you can avail of a card while building your score for next time.

Secured Credit Card

A secured credit card is usually offered to people with no or bad credit score. Some banks will require you to provide a deposit, which can act as your credit limit.

Co-Signee

Another thing that you can do is to look for a co-signee, it can be a family member or a friend, who is willing to co-sign with you to get a credit card. Just make sure that your co-signee has a good credit score for you to get approved.

Credit cards with a credit score over 500

There are now a lot of credit cards for people with a credit score over 500 but under 550.

Not everyone can have a perfect credit score to avail of whatever credit card they like. Fortunately, individuals with lower credit score can now have the option to choose the available credit cards for them. Below are some of the best cards for a credit score over 500 but under 550.

Primor Secured Visa Gold

Primor Secured Visa Gold has a minimum deposit of USD 200, which will serve as your credit limit. The annual fee for this card is USD 49, and the regular APR is 9.99%.

Primor Secured Visa Classic Credit Card

Primor Secured Visa Classic has a minimum deposit of USD 200, which will be your credit limit. The card has an annual fee of USD 39 and a regular APR of 13.99%.

Car loans with a credit score over 500

Car loans with a credit score over 500 but under 550 can get a loan with an average interest rate. All you have to do is to find the right car loan for yourself.

People today have different options when it comes to car loans. That is why it is important to know the different methods that you have so you can choose from them. Of course, the type of loan will depend on your budget. Find out the options to choose from by reading the information below.

Simple Loan

If you are into the details of your finances, then choosing the simple loan is essential. The interest of your loan is computed every single day. You can lessen the interest by selecting to pay biweekly.

Pre-Computed Loan

The pre-computed loan is where the company will create a pre-computed loan; wherein the borrower can see the principal amount and the interest rate of the loan. You can review it, and if you agree with the calculations and terms, you need to sign the paper. Once approved, you will need to pay every dollar in the contract that is owed.

Mortgages with a credit score over 500

You should always look for ways to improve your credit score and make your credit position healthier to be able to exercise your options when required.

With a low score in the range of 500 to 550, you can target the low scale banks. Local banks may also be willing to lend you with such a score.

You can apply for a credit union and become a member of one that operates in your region. Credit Unions are not for profit organizations, and they do not charge you with higher interest rates or any other charges. Their terms and conditions are easily manageable.

Home Loans with a credit score over 500

A low credit score doesn't imply that you have no option available to get a home loan. You still have some options that can be availed. First, look for the government sponsored home and mortgage plans. In the United States, you have FHA loans. These loans require a particular criterion, and if you fulfill those requirements, you can get loans from FHA approved lenders. It is one of the best options available because you will be paying lower interest rates and the overall loan amount could be higher than what is offered to you.

You could also qualify for the low-credit mortgage. In an automated request, you may fail. But, you can try it on your own, and if you can prove you have enough cash or have been able to pay your last 12 months rent on time, your chances of getting the approval are comparatively significant.

Personal Loans with a credit score over 500

We all need financial support from time to time. Personal loans present a good solution in financially difficult times. A credit score has an impact on the number of avenues available to get these loans, as well as the total amount awarded.

Vouching

Sometimes you may be given a loan courtesy of a recommendation by a person with a good credit score. The person recommending you has to be a trusted customer or staff member of the institution giving you the loan.

Home equity loan

With your home as security, some banks might be flexible enough to give you a personal loan. In this case, you might be able to secure a significant amount with a longer repayment period.

Peer to peer loan

There are numerous online lending platforms in which you can get a personal loan. The interest rates and repayment vary from one platform to another. Some may require you to appear personally in their branches before the final approval of your loan.

Things you can do to improve your credit score of 500

It has become difficult to obtain credit with a lower credit rating. It is your responsibility to make sure that you have a solid financial footing for you to access loans. We all want o access cheap credit, and the only way that can happen is to have a good rating. Some steps can help you to improve it.

Cancel unnecessary credit cards

You should consider canceling cards accounts that you don't use. Financiers usually assess the amount of credit is available to you, other than what are using. It also reduces the chances of falling prey to fraudsters if you losses the credit cards.

Pay up on time

The importance of making timely premium payments can never be emphasized enough. Prompt payments show that you are a responsible borrower thus boosting your rating. You need to make sure you have funds available for any emergencies to avoid interfering with your loan repayment plan.

Fix credit by yourself

Some companies have come up that promise to repair poor credit on behalf of borrowers. There is no need to believe in this hype since you can work to improve your rating just by yourself. All you need to do is to adhere to the terms of the loan.