Understand the meaning of having a credit score above 750, how it's calculated, what loans you can get, and how to improve your score

A credit score is needed for you to be able to get a loan or credit. The reason behind this is because it will help financial institutions to determine your creditworthiness. They will also see every loan that you made and the payment history that you have. Find out more about it by reading the information below.

Credit scores are calculated based on the proprietary algorithm. This will include the person's outstanding debts, payment history, and the length of the individual's credit history.

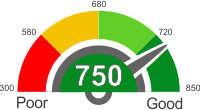

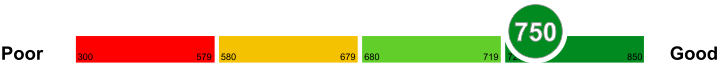

Credit scores can range from 300 to 850. The higher the individual's score, the lower the risk. People who have lower credit scores are considered high risk, which will make lending companies ask for more requirements.

About Fico scores

Fair Isaac Corporation is the one who established FICO, and it is one of the most commonly used credit scoring systems today.

According to FICO, 90% of the most reputable and respected lenders today are making decisions according to this kind of credit scoring system. Get to know more about Fico scores by reading the information below.

How are credit scores calculated?

The weight of each of the five categories are; 30% of amount owned, 10% is for the new credit, 15% accounts for the length of credit history, 10% is the credit mix and the last 35% accounts for the person's payment history.

The FICO score takes into consideration positive as well as negative aspects of the credit report. The percentage or the weight of any of the categories mentioned above may differ from a person to another depending upon the information available in the credit report.

The FICO score takes all of the information from your credit report. However, the banks or any other lending institution might look at your income, type of credit and employment history when you apply for a loan or mortgage.

Once a certain lender asks for a client's credit report, they can also ask for the Fico score. Other sources say that your Fico score will include 35% of your payment history, 30% of your credit utilization, and 15% as to how long have you been borrowing.

Explanation of credit score ranges

It is important to know the category that you fall into when it comes to credit score for you to be aware. The range of a credit score can go from 300 to 850. Always remember that the higher your score, the higher the chances of you to qualify for a loan. There will also be instances where a financing company is okay with 650 scores, while the other is fine with a 750 score. It will all depend on the lender itself.

A lender or a bank will check your credit score if you qualify for the application that you are requesting. Here are some of the credit score ranges that you should know.

Bad credit score

People with a credit score below 579 is known as high risks. Foreclosures, poor payment history, and bankruptcies are the reasons why people fall into this category.

Good credit score

A good credit score ranges from 680 to 719. People with this credit score can expect approvals and interest rates that are better.

Very Good

A very good credit score ranges from 720 to 799. People with this credit score is known to be small risks, and they often get loan amounts that are higher than usual.

Excellent

An excellent score ranges from 800 and above. Financial freedom is expected to people with this score.

What does it mean to have a credit score over 750

So what does it mean to have a credit score over 750 but under 800? Find out by reading the information below.

There are numerous benefits of having a credit score over 750 but under 800. The reason behind this is because this score is considered as an excellent rating. People with this score have proven their creditworthiness to financial institutions. Below are some of the benefits that you will surely love to have when you reach this credit score.

Higher Chance of Approval

With your credit score, the chances of getting approve are definitely high. This is the reason people with this credit score are confident when it comes to applying for credit.

Easy Approval for Rentals

If you plan to rent an apartment or a house, you don't have to worry much, because landlords can quickly approve your application.

Credit cards with a credit score over 750

Credit cards with a credit score over 750 but under 800 have numerous benefits plus they always come with a lower interest rate, due to this excellent score.

For people with a credit score over 750 but under 800, choosing a credit card can be difficult because there are just too many to options available. One of the useful features is the cash back since you get to earn while you're spending. Here are some of the cards with real cash backs.

Discover It

Discover It will let you turn USD 200 into USD 400, and this is for new members only. It will also help you earn 5% cash back for restaurants, gas, and even when purchasing from Amazon.

Barclaycard Rewards MasterCard

Barclaycard Rewards will let you earn twice the points on grocery, utility, and gas stores. It has no annual fee and has a regular APR of 25.24%.

Car loans with a credit score over 750

Qualifying for car loans with a credit score over 750 but under 800 is not as hard as everyone thinks.

One of the primary goals of car dealerships today is to sell as much car as they can. That is why with a credit score over 750 but under 800, you shouldn't be worried at all because even people who have lower credit score can get a car loan for themselves. So how do you get approval for the loan that you need? Find out by reading the information below.

Finance Company

It would be best to contact the company directly instead of the auto dealership. Directly contacting them will help you to create a better deal with them, instead of the dealership itself. You can also negotiate with the interest rates and the terms if possible.

Additional Documents

It would also be best if you include some bills where your address of residence can be viewed. The reason behind this is because most finance companies will need to verify your address before granting you your loan.

Mortgages with a credit score over 750

You should always look for ways to improve your credit score. It puts you in a better position to get your loan approval and acquire credit whenever you need it.

If your score is over 750 but below 800, you have a very good credit score. You can expect to get the best possible loan or mortgage offers available in the banking sector. You can check with the lending institutions and get a complete idea of the interest rates and then select the one that suits you best.

You can check with the government sponsored home loan or mortgage plans. FHA approved lenders might be willing to lend you at the lowest possible interest rates.

Home Loans with a credit score over 750

The credit score that lies over 750 shows a brilliant credit history and creditworthiness. You are more likely to get the best possible offers and discounts on loans than any person that has a lower credit score.

With a credit score over 750 and below 800, you can expect to get the best loan options from the major banks. You can use your credit history to get a higher amount of home loan, with lower interest rates. Your best option would be to go to banks that have the best home loan offers in the market.

You can go to the financial institutions that specialize in home loans and use your high credit score in your favor. Also, you can apply for the government-sponsored plans of home loans which will provide you with comparatively flexible terms and conditions.

Other options include; taking a loan from family, friends or acquiring a credit card.

Personal Loans with a credit score over 750

Banks and credit unions usually provide you with a personal loan after performing a hard credit check. For this reason, online peer to peer lenders are gaining footing due to soft credit checks. They equally offer competitive interest rates just like traditional financiers.

Earnest

This service charges no application or processing fees for your personal loan. It is possible for you to adjust the terms of the loan, as well as the due dates. Applicants with a credit score of over 700 with a steady income are preferred.

SoFiIt does not charge you an origination fee and provides large amounts of up to $100,000. Sometimes your loan repayment can be paused if you experience credible, verifiable difficulties. Should your employment be terminated, they offer you career counseling.

Lightstream

It provides you with low-interest rates that are customized in line with the purpose of your loan. They don't charge you any origination fees for your personal loan.

Things you can do to improve your credit score of 750

You don't have to pay a credit repair company to help you in fixing your credit score. There are some easy steps you can take to improve your credit score without involving any third party. The loan agreement is made between you and the lender hence suggesting a secondary may prove injurious to your rating.

Pay off your debts

You can enhance your credit score by reducing the amount of debt you have. You can do this by giving priority to the debts attracting higher interest. You also lower the amount of interest you pay thus increasing your credit score.

Consolidate your credit cards

If you own several cards from one financier, you can amalgamate the newer ones into the older ones. You only have to ensure the total limit remains unchanged. This action increases the average age of the revolving lines of credit while your total credit is not restricted.

Don't be late with your premiums

This method has been tried and tested and proved to be efficient. Making timely payments as per the loan terms is crucial to being in control of your debt helping you in increasing your credit score.