Understand the meaning of having a credit score above 800, how it's calculated, what loans you can get, and how to improve your score

A credit score is needed for you to be able to get a loan or credit. The reason behind this is because it will help financial institutions to determine your creditworthiness. They will also see every loan that you made and the payment history that you have. Find out more about it by reading the information below.

Credit scores are calculated based on the proprietary algorithm. This will include the person's outstanding debts, payment history, and the length of the individual's credit history.

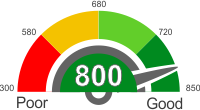

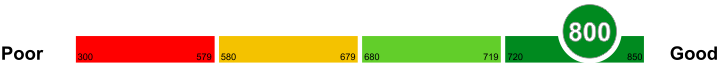

Credit scores can range from 300 to 850. The higher the individual's score, the lower the risk. People who have lower credit scores are considered high risk, which will make lending companies ask for more requirements.

About Fico scores

Fair Isaac Corporation is the one who established FICO, and it is one of the most commonly used credit scoring systems today.

According to FICO, 90% of the most reputable and respected lenders today are making decisions according to this kind of credit scoring system. Get to know more about Fico scores by reading the information below.

How are credit scores calculated?

The weight of each of the five categories are; 30% of amount owned, 10% is for the new credit, 15% accounts for the length of credit history, 10% is the credit mix and the last 35% accounts for the person's payment history.

The FICO score takes into consideration positive as well as negative aspects of the credit report. The percentage or the weight of any of the categories mentioned above may differ from a person to another depending upon the information available in the credit report.

The FICO score takes all of the information from your credit report. However, the banks or any other lending institution might look at your income, type of credit and employment history when you apply for a loan or mortgage.

Once a certain lender asks for a client's credit report, they can also ask for the Fico score. Other sources say that your Fico score will include 35% of your payment history, 30% of your credit utilization, and 15% as to how long have you been borrowing.

Explanation of credit score ranges

It is important to know the category that you fall into when it comes to credit score for you to be aware. The range of a credit score can go from 300 to 850. Always remember that the higher your score, the higher the chances of you to qualify for a loan. There will also be instances where a financing company is okay with 650 scores, while the other is fine with a 750 score. It will all depend on the lender itself.

A lender or a bank will check your credit score if you qualify for the application that you are requesting. Here are some of the credit score ranges that you should know.

Bad credit score

People with a credit score below 579 is known as high risks. Foreclosures, poor payment history, and bankruptcies are the reasons why people fall into this category.

Good credit score

A good credit score ranges from 680 to 719. People with this credit score can expect approvals and interest rates that are better.

Very Good

A very good credit score ranges from 720 to 799. People with this credit score is known to be small risks, and they often get loan amounts that are higher than usual.

Excellent

An excellent score ranges from 800 and above. Financial freedom is expected to people with this score.

What does it mean to have a credit score over 800

Find out what does it mean to have a credit score over 800 but under 850 by reading the information below.

Having a credit score over 800 but under 850 is a stellar score that will make lending companies more than willing to grant you a loan. Some people think that having an excellent score means getting incredible rates on loans, but there are more to it.

Deals on Credit Cards

Credit card companies will offer you the best cards that they have, which will include cash backs, rewards, and interest rates that are low. Just make sure to continue paying promptly.

Utility Company

Some of the utility companies today may check your credit report when applying for one. If your credit score is over 800 but under 850, they will no longer require you to provide a deposit.

Credit cards with a credit score over 800

Applying for credit cards with a credit score over 800 but under 850 is easier since this score range is known as an excellent one.

There are a lot of credit cards today but choosing the best that you can have is essential. A credit score over 800 but under 850 gives you the freedom to choose the right card for yourself. Here are some of the credit cards available for your credit score.

Capital One Venture

Capital One Venture lets the cardholder earn twice the miles for every dollar spent. If you spend USD 3,000, you can earn a bonus of up to 40,000 miles. It has an annual fee of USD 59.

American Express Blue Cash Preferred

American Express Blue Cash Preferred lets you earn USD 150 cash back after spending USD 1,000 on purchases. It has a 0% APR for the first year and 13.24% to 23.24% after that.

Car loans with a credit score over 800

People who are planning to get car loans with a credit score over 800 but under 850 should not worry about getting declined. The reason behind this is because most financing companies consider this credit score an excellent score.

There are different types of loan options for people who are looking for car financing. If this is your first time to get a car loan and you have a credit score of over 800 but under 850, then knowing the options that you have is essential.

Financing Through Dealership

Financing through a dealership is usually based on the credit score of the person applying. The interest rate will depend highly on the applicant's score. The higher the score, the lower the interest and vice versa.

Leasing a Car

Now if you not sure about buying a car or not ready yet, it would be best to just a lease one. There are leasing companies today wherein they are offering affordable monthly payments and interest rates that are lower than usual.

Mortgages with a credit score over 800

You ought to search for approaches to enhance your rating score. It places you in a better position to get your loans and gain credit at whatever point you require it.

When your score is more than 800 however underneath 850, you have the best credit score possible. You can virtually get an ideal home loan offers accessible. You can check with the lending firms and after that select the one that suits you best.

You should check with the government supported home credit or home loan arrangements. FHA endorsed lenders should be willing to loan you at the most reduced conceivable financing costs.

Home Loans with a credit score over 800

The highest credit scores that you can get is 850 which shows your brilliant creditworthiness. However, the difference in benefits is marginal over the credit score of 750. If you have a credit score of over 800, you will qualify for virtually all the different kinds of home loan offerings.

You will be eligible for a larger amount of home loans from the major banks in the market. You will, most likely, be paying the lowest possible interest rates and the approval rate for your home loans will be better than those people who have a lesser credit score.

You can also apply for government home loans. You have a large variety of options which differentiate regarding loan amount, interest rates, down payment and the period of returning the credit amount.

Personal Loans with a credit score over 800

A credit score that is above 800 is considered to be excellent. Any person loan application with this score is guaranteed to be approved. At this rate, you have access to any type of personal loan available from all kinds of lenders ? you are spoilt for choice!

Unsecured bank loan

You can walk into a bank and be issued with a personal loan just with your signature. You don't need any form of collateral. Proof of employment and a steady income is required for this loan to be approved.

Credit union loanIt is very easy for a credit union to trust you with any amount of money you apply for as long as you are one of its members. You only need to prove that you have the ability to repay the loan within the specified period.

Co-signer loan

If you have another loan that you are currently servicing, you can engage another signatory to obtain a personal loan from a bank. This loan is suitable when you are investing in an income generating activity.

Things you can do to improve your credit score of 800

A score of 800 and above means that you have an excellent credit rating. It should not stop you from maintaining or improving it. You should not get too comfortable and take things for granted to a point where you forget your financial obligations. Doing this means that your credit rating my end up being damaged.

Increase your credit limit

This action improves you're the ratio of your credit utilization, which refers to the proportion of the credit limit you use versus what is available. Make a request for credit line increase, but if the lender intends to do a hard pull you can withdraw since it lowers your credit.

Tighten your privacy and security

Fraudsters may open credit accounts in your name without your name. Ensure you read your periodical reports to ensure they don't contain credit you haven't solicited. Don't share too much personal information on social media that fraudsters can take advantage of.

Clear your debts

Ensure that you owe no lender any outstanding amount. Even a $0.1 could have an impact on your credit score since it is still considered debt; worse still, it could be attracting interest. Lenders cannot trust you if you have long-running debts.