Discover what it means to have a credit score below 486, how it's calculated, what loans you can get, and how to improve your credit score

A credit score is needed for you to be able to get a loan or credit. The reason behind this is because it will help financial institutions to determine your creditworthiness. They will also see every loan that you made and the payment history that you have. Find out more about it by reading the information below.

Credit scores are calculated based on the proprietary algorithm. This will include the person's outstanding debts, payment history, and the length of the individual's credit history.

Credit scores can range from 300 to 850. The higher the individual's score, the lower the risk. People who have lower credit scores are considered high risk, which will make lending companies ask for more requirements.

About Fico scores

Fair Isaac Corporation is the one who established FICO, and it is one of the most commonly used credit scoring systems today.

According to FICO, 90% of the most reputable and respected lenders today are making decisions according to this kind of credit scoring system. Get to know more about Fico scores by reading the information below.

How are credit scores calculated?

The weight of each of the five categories are; 30% of amount owned, 10% is for the new credit, 15% accounts for the length of credit history, 10% is the credit mix and the last 35% accounts for the person's payment history.

The FICO score takes into consideration positive as well as negative aspects of the credit report. The percentage or the weight of any of the categories mentioned above may differ from a person to another depending upon the information available in the credit report.

The FICO score takes all of the information from your credit report. However, the banks or any other lending institution might look at your income, type of credit and employment history when you apply for a loan or mortgage.

Once a certain lender asks for a client's credit report, they can also ask for the Fico score. Other sources say that your Fico score will include 35% of your payment history, 30% of your credit utilization, and 15% as to how long have you been borrowing.

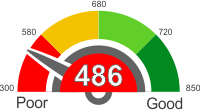

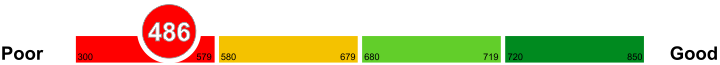

Explanation of credit score ranges

It is important to know the category that you fall into when it comes to credit score for you to be aware. The range of a credit score can go from 300 to 850. Always remember that the higher your score, the higher the chances of you to qualify for a loan. There will also be instances where a financing company is okay with 650 scores, while the other is fine with a 750 score. It will all depend on the lender itself.

A lender or a bank will check your credit score if you qualify for the application that you are requesting. Here are some of the credit score ranges that you should know.

Bad credit score

People with a credit score below 579 is known as high risks. Foreclosures, poor payment history, and bankruptcies are the reasons why people fall into this category.

Good credit score

A good credit score ranges from 680 to 719. People with this credit score can expect approvals and interest rates that are better.

Very Good

A very good credit score ranges from 720 to 799. People with this credit score is known to be small risks, and they often get loan amounts that are higher than usual.

Excellent

An excellent score ranges from 800 and above. Financial freedom is expected to people with this score.

What does it mean to have a credit score under 486

The credit score can range from 300 to 850. A score below 486 would be unacceptable for most of the major banks in your area. At this moment, you should consider looking for tips and techniques to improve your credit score in a short amount of time.

If you have such a low credit score, you can opt for the credit card option. The reason for that being, the credit card companies are not much interested in your credit score. Moreover, you will be required to use the non-conventional means of acquiring loans or credits.

Credit cards with a credit score under 486

Credit cards with a credit score under 486 but over 400 can be difficult to avail due to the bad score.

Some people opt for a secured credit card because it is easier to avail than the unsecured one. If you are not familiar with this type of card, then the information below will help you decide if this is the card for you.

Requires a Deposit

A secured credit card requires a deposit because it will act as your credit line. The deposit acts as collateral in case you can no longer pay your bill; the bank can use the deposit to pay up for your debt.

Helps Improve credit score

If you have a poor credit score, then getting a secured credit card is essential. The reason behind this is because it helps improve your credit score, for as long as you are paying them on time.

Car loans with a credit score under 486

Car loans with a credit score under 486 but over 400 are a challenge to some since this score is known as a poor one.

Getting a car loan with a poor credit score may be challenging, but there are different ways on how you can get the approval that you need. It can be a hassle to go through all the process and just get rejected in the end. Here are some tips on how you can get the approval that you need for that car loan.

Specialized Lenders

The first thing that you can do is to go to specialized lenders instead of going to other financing companies. These specialized lending companies will most probably approve the loan but you will have to endure high interest rates.

Provide Documents

It would also be best to provide the company with the documents that they need to verify your identity and your financial capabilities. You can provide bills and bank statements. The more proof you give them, the higher your chances of getting approved.

Mortgages with a credit score under 486

With a score that is below 486 but 400, it is not easy to acquire loans. Banks that would be willing to lend you credit for your home loan or mortgage will charge you higher interest rates and strict terms.

You can always go to a credit card company and apply for one. They pay little attention to your current credit score. Therefore, you can use a credit card to finance your loan or mortgage.

At this stage, you should be looking at ways to improve your credit score. Higher your credit score, better offers you get for your loan or credit needs. Moreover, a good score also helps in getting loan approval quickly.

Home Loans with a credit score under 486

If your credit score is below 486 but above 400, it will be difficult to qualify for home loans through major banks. You might face difficulty in getting loans from FHA-approved lenders too.

Therefore, with such a low score, you will be required to go to sub-prime mortgage lenders. They specialize in providing loans to people that have low credit scores. You can also look for a new credit card. Credit card providers pay lesser attention to your overall credit score. However, in the process of doing so, you may be required to pay higher interest rates.

You should plan your mortgage or home loan ahead of time. By doing so, you will have a better idea of all the options available in the market, and therefore, you can make the necessary changes to your score to reach your desired loan offers.

Personal Loans with a credit score under 486

At some point, everyone needs an alternative financing scheme for their day to day activities. There are so many ways you can get assistance, which include seeking for personal loans. With low credit scores, not many organizations are willing to support you. When they do, the interest rates are usually high.

Co-signer loan

You can have someone to be one of the signatories of the loan you are obtaining. A co-signer is issued with warnings when you fail to pay your premiums. A co-signer runs the risk of damaging their credit score if the loan is not settled as per the terms.

Home equity loan

Sometimes it might be necessary to your home as security for obtaining a personal loan. This loan can get you a significant loan amount and a longer repayment period. It should come as a last option especially if you are not sure that your compensation plan will work out for you correctly.

Peer to peer loan

There are online platforms that allow customers and investors to transact in loans. Your loan request is displayed on a listing for potential investors to assess. If an investor is satisfied in your qualified, they provide you with a personal loan.

Things you can do to improve your credit score of 486

You still have the hope of improving your credit score of 486 if you take proactive steps. Showing signs that you are exponentially trying to improve your financial status through prompt credit repayments ensures your rating gets a constant boost. Even if you have bad credit, financiers will view you positively if you are making an effort to improve on it.

Paying your bills on time

You don't need to wait until the last minute or after being reminded by the financier for you to repay the loan you have taken. You take a loan voluntarily. Therefore, you are expected to be responsible for it. Show good faith by paying it on time and through the proper channel.

Avoid altering payment plans

Missing your payments or reducing hem suddenly affects your credit score negatively. Other practices that could damage your rating include taking cash advances, using your credit card for activities that show present or future financial constraint like in pawn shops.

Planning before seeking credit

You should plan for the future before applying for credit. It is recommended to take credit in a lump sum rather than doing individual, periodical applications for every need. Your credit score takes a slight dent every time you apply for credit.