Discover what it means to have a credit score below 500, how it's calculated, what loans you can get, and how to improve your credit score

A credit score is needed for you to be able to get a loan or credit. The reason behind this is because it will help financial institutions to determine your creditworthiness. They will also see every loan that you made and the payment history that you have. Find out more about it by reading the information below.

Credit scores are calculated based on the proprietary algorithm. This will include the person's outstanding debts, payment history, and the length of the individual's credit history.

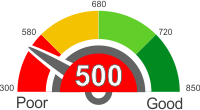

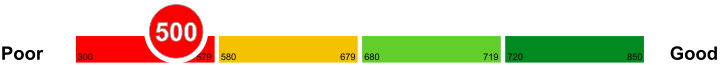

Credit scores can range from 300 to 850. The higher the individual's score, the lower the risk. People who have lower credit scores are considered high risk, which will make lending companies ask for more requirements.

About Fico scores

Fair Isaac Corporation is the one who established FICO, and it is one of the most commonly used credit scoring systems today.

According to FICO, 90% of the most reputable and respected lenders today are making decisions according to this kind of credit scoring system. Get to know more about Fico scores by reading the information below.

How are credit scores calculated?

The weight of each of the five categories are; 30% of amount owned, 10% is for the new credit, 15% accounts for the length of credit history, 10% is the credit mix and the last 35% accounts for the person's payment history.

The FICO score takes into consideration positive as well as negative aspects of the credit report. The percentage or the weight of any of the categories mentioned above may differ from a person to another depending upon the information available in the credit report.

The FICO score takes all of the information from your credit report. However, the banks or any other lending institution might look at your income, type of credit and employment history when you apply for a loan or mortgage.

Once a certain lender asks for a client's credit report, they can also ask for the Fico score. Other sources say that your Fico score will include 35% of your payment history, 30% of your credit utilization, and 15% as to how long have you been borrowing.

Explanation of credit score ranges

It is important to know the category that you fall into when it comes to credit score for you to be aware. The range of a credit score can go from 300 to 850. Always remember that the higher your score, the higher the chances of you to qualify for a loan. There will also be instances where a financing company is okay with 650 scores, while the other is fine with a 750 score. It will all depend on the lender itself.

A lender or a bank will check your credit score if you qualify for the application that you are requesting. Here are some of the credit score ranges that you should know.

Bad credit score

People with a credit score below 579 is known as high risks. Foreclosures, poor payment history, and bankruptcies are the reasons why people fall into this category.

Good credit score

A good credit score ranges from 680 to 719. People with this credit score can expect approvals and interest rates that are better.

Very Good

A very good credit score ranges from 720 to 799. People with this credit score is known to be small risks, and they often get loan amounts that are higher than usual.

Excellent

An excellent score ranges from 800 and above. Financial freedom is expected to people with this score.

What does it mean to have a credit score under 500

If it seems that the risk of default is high with your loan request, the bank will ask you to pay for higher interest rate on your loan amount. Therefore, it is vital for you to have a high credit score if you want easy conditions and lower interest rates against your loan and credit.

With a credit score of under 500 and above 450, small-scale, local banks may be willing to lend you credit or loan. But, their overall cost of debt will be higher for you and you will be required to pay on time strictly.

Credit cards with a credit score under 500

People with a credit score under 500 but over 450 might encounter problems when it comes to applying for a credit card.

Banks are usually hesitant to grant unsecured credit cards to people with low credit score. The reason behind this is because of the already damaged history when it comes to money. But don't worry because there are still a few ones who can grant you a credit card to help you rebuild your credit score.

Indigo MasterCard

No matter what your credit score is, Indigo MasterCard will qualify you for this card. It has a fraud protection for lost cards and stolen ones. The history of this account is reported to the US credit card bureaus., which will help you enhance your score.

DCU Platinum Secured

DCU Platinum Secured has no annual fee and has a regular APR of 11.75%. No matter how bad your credit score is, you will still get a chance to avail of this card.

Car loans with a credit score under 500

For people who are planning to get car loans with a credit score under 500 but over 450, this might not be an easy task.

As you all know, car loan companies are helping people to but the car that they need, despite the fact that some don't have any fund resources at the time. But of course, they need certain requirements for them to be able to grant the loan that people need, and one of those needs is having a good credit score.

credit score under 500 but under 450

A credit score of under 500 but under 450 means you will have a hard time getting your loan approve since this is a poor score. But of course, lending companies will give considerations so it wouldn't be much of a problem.

Improving Your credit score

Improving your credit score means paying everything in a timely manner. You can also start paying off your debts as this will surely improve your current score. The higher your score the higher your chances of getting the approval that you need.

Mortgages with a credit score under 500

With such a score, you can target the local or small scale banks. The local or small scale banks might charge you higher interest rates, but the probability of getting loan request approved is higher compared to mid or top-tier banks. Most of the large size banks might not approve your application for a new home loan or mortgage.

You can also contact the credit card companies and get yourself one that has the best credit offers that suit you. It is an easier way to get cash or credit quickly. Credit card companies do not give much attention to your credit score too.

Home Loans with a credit score under 500

A credit score that is below 500 but above 450 falls in the bottom category on the grade scale. Getting loan approvals with such a low score will be difficult. Most of the banks may reject your request for home loans. Therefore, you have to look for different options.

You can get a friend or family member that have a better credit score to get the loan from the banks for you. If you have high income or money is available at the time, you should look to deposit a down payment of 10% or 20% upfront to your increase your chances of getting the home loan.

You can always acquire a new credit card for the loan, but the cost of funds would be higher. Going to a sub-prime mortgage lender may be your best option in these circumstances. They specialize in providing the best loan options to people that have low credit score.

Personal Loans with a credit score under 500

Financial difficulties are not always anticipated for, but when they do quick fixes are necessary. A personal loan goes a long way in ensuring your progress is not halted due to a shortage of funds. It is a quick way of injecting funds into your projects. You can get a personal loan from multiple sources depending on your credit score and needs.

Personal installment loan

This loan should only be considered after exploring all other avenues, and they have failed. It is a very high-interest rate loan that should only be sought for during emergencies. The amount you can be issued depends on the interest rate that you are willing to pay.

Title loan

The title of your car can get you a personal loan for emergencies. You simply hand its logbook to a financial institution or car dealer for the period the loan is given to you. It is always risky to use your valuables thus you need to be sure of how you are going to settle the loan otherwise you would lose the car.

Secured bank loan

You need some of security for your personal loan to be issued. It could be some property or form of investment that you own. It is suitable when you need a long-term loan and in large amounts.

Things you can do to improve your credit score of 500

It has become difficult to obtain credit with a lower credit rating. It is your responsibility to make sure that you have a solid financial footing for you to access loans. We all want o access cheap credit, and the only way that can happen is to have a good rating. Some steps can help you to improve it.

Cancel unnecessary credit cards

You should consider canceling cards accounts that you don't use. Financiers usually assess the amount of credit is available to you, other than what are using. It also reduces the chances of falling prey to fraudsters if you losses the credit cards.

Pay up on time

The importance of making timely premium payments can never be emphasized enough. Prompt payments show that you are a responsible borrower thus boosting your rating. You need to make sure you have funds available for any emergencies to avoid interfering with your loan repayment plan.

Fix credit by yourself

Some companies have come up that promise to repair poor credit on behalf of borrowers. There is no need to believe in this hype since you can work to improve your rating just by yourself. All you need to do is to adhere to the terms of the loan.