Discover what it means to have a credit score below 750, how it's calculated, what loans you can get, and how to improve your credit score

A credit score is needed for you to be able to get a loan or credit. The reason behind this is because it will help financial institutions to determine your creditworthiness. They will also see every loan that you made and the payment history that you have. Find out more about it by reading the information below.

Credit scores are calculated based on the proprietary algorithm. This will include the person's outstanding debts, payment history, and the length of the individual's credit history.

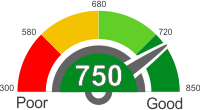

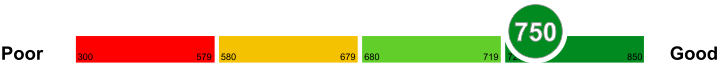

Credit scores can range from 300 to 850. The higher the individual's score, the lower the risk. People who have lower credit scores are considered high risk, which will make lending companies ask for more requirements.

About Fico scores

Fair Isaac Corporation is the one who established FICO, and it is one of the most commonly used credit scoring systems today.

According to FICO, 90% of the most reputable and respected lenders today are making decisions according to this kind of credit scoring system. Get to know more about Fico scores by reading the information below.

How are credit scores calculated?

The weight of each of the five categories are; 30% of amount owned, 10% is for the new credit, 15% accounts for the length of credit history, 10% is the credit mix and the last 35% accounts for the person's payment history.

The FICO score takes into consideration positive as well as negative aspects of the credit report. The percentage or the weight of any of the categories mentioned above may differ from a person to another depending upon the information available in the credit report.

The FICO score takes all of the information from your credit report. However, the banks or any other lending institution might look at your income, type of credit and employment history when you apply for a loan or mortgage.

Once a certain lender asks for a client's credit report, they can also ask for the Fico score. Other sources say that your Fico score will include 35% of your payment history, 30% of your credit utilization, and 15% as to how long have you been borrowing.

Explanation of credit score ranges

It is important to know the category that you fall into when it comes to credit score for you to be aware. The range of a credit score can go from 300 to 850. Always remember that the higher your score, the higher the chances of you to qualify for a loan. There will also be instances where a financing company is okay with 650 scores, while the other is fine with a 750 score. It will all depend on the lender itself.

A lender or a bank will check your credit score if you qualify for the application that you are requesting. Here are some of the credit score ranges that you should know.

Bad credit score

People with a credit score below 579 is known as high risks. Foreclosures, poor payment history, and bankruptcies are the reasons why people fall into this category.

Good credit score

A good credit score ranges from 680 to 719. People with this credit score can expect approvals and interest rates that are better.

Very Good

A very good credit score ranges from 720 to 799. People with this credit score is known to be small risks, and they often get loan amounts that are higher than usual.

Excellent

An excellent score ranges from 800 and above. Financial freedom is expected to people with this score.

What does it mean to have a credit score under 750

The credit score shows how you have managed your credit and loans in the past. With a credit score of 700, it implies that you have the ability to pay back the loans on time in the future. Lower risk of default will be associated with your loan request, and banks will be willing to lend you the necessary credit or loan.

You can search for the different credit and loan offerings available in the market and opt for the one that is the most suitable and feasible for you. With slight adjustments and some improvements, you can jump over the 750 mark and enjoy the best possible rates in your region.

Credit cards with a credit score under 750

A credit score under 750 but over 700 is known as a good score, which means that there are good credit cards offer for people with a credit score like this.

There are a lot of credit cards today, and they all come with competitive benefits and offers. If you are one of the many who have a credit score under 750 but over 700, then these are the cards that are perfect for you.

Capital One VentureOne

Capital One VentureOne will give you 20,000 miles bonus once you spend USD 1,000 on purchases during the first three months. It has a zero annual fee and their APR is 21.24% to 22.24%.

Citi ThankYou

Citi ThankYou lets you earn a bonus of 2,500 points once you spend USD 500 on purchases within the first three months. It also has a zero annual fee, while the ongoing APR is 14.24% to 24.24%.

Car loans with a credit score under 750

Applying for a car loan is the easiest loan one can apply for, which is why if you are planning to get one then you should not worry.

Most people probably know all the requirements needed for them to be able to get the car loan that they need for the car that they've been eyeing. But familiarizing yourself with the rates and the terms that financing companies have is important. In this way, you know the best company to get the loan.

Comparing Rates

You can check websites of lending companies or even banks because most of them post their rates there. By doing this, it will save you a lot of time instead of visiting each and every establishment or bank in your area.

Comparing Loan Terms

Most car loan companies have terms for 3 to 5 years. The interest rate will depend on the duration of your loan, so always make sure that you are comparing all of them for you to be able to get the best offer.

Mortgages with a credit score under 750

With a score that is below 750 but above 700, you can use the conventional and non-conventional ways of acquiring a home loan and mortgage. You can either go to banks or other lending institutions to borrow credit or mortgage. You can look at the interest rates and time period of these offers and select one that suits you.

You can also apply for government loans or new home leasing schemes too. With a good score like this, your loan request is most likely going to get approved.

You can go with the one that offers lowest possible interest rates, and that has manageable terms and conditions for the credit.

Home Loans with a credit score under 750

A credit score that is below 750 and above 700 is considered ?very good' category on the grade scale. You can go for loans through conventional ways of getting loans i.e. through banks. Some of the major banks would be willing to lend you home loans at competitive rates of interest.

You can have a look at the option of Federal Housing Administration approved loans. They are related to government and therefore, you can expect lower interest rates on the home loans. A score of above 700 is sure to qualify for the government loan options.

You may also have a look at the opportunities of increasing your credit to the ?excellent' category and enjoy the best interest rates on the loan.

Personal Loans with a credit score under 750

It is a good credit score that will qualify you for a wide variety of personal loans. Most banks and other financial institutions will approve your application for credit. What you need to be on the lookout for are the interest rate and repayment period. You don't want to take a loan that will choke you financially.

Unsecured personal loan

This loan doesn't require any form of security. It is usually provided for individuals with good credit history and a steady source of income. It has a fixed rate of interest and repayment period. It is structured as an installment loan paid at regular intervals usually monthly.

Peer to peer loan

These are only micro-lenders that provide loans within a short period. Your loan is approved swiftly if you have a minimum credit score of 640. The application process is simple, and funds can be made available in a matter of hours.

Credit union loan

These are institutions offering complementary financial services including personal loans for their members. The loans are not offered at a profit since their aim is to support and empower their members financially. Join at least one credit union for softer loans.

Things you can do to improve your credit score of 750

You don't have to pay a credit repair company to help you in fixing your credit score. There are some easy steps you can take to improve your credit score without involving any third party. The loan agreement is made between you and the lender hence suggesting a secondary may prove injurious to your rating.

Pay off your debts

You can enhance your credit score by reducing the amount of debt you have. You can do this by giving priority to the debts attracting higher interest. You also lower the amount of interest you pay thus increasing your credit score.

Consolidate your credit cards

If you own several cards from one financier, you can amalgamate the newer ones into the older ones. You only have to ensure the total limit remains unchanged. This action increases the average age of the revolving lines of credit while your total credit is not restricted.

Don't be late with your premiums

This method has been tried and tested and proved to be efficient. Making timely payments as per the loan terms is crucial to being in control of your debt helping you in increasing your credit score.