Discover what it means to have a credit score below 800, how it's calculated, what loans you can get, and how to improve your credit score

A credit score is needed for you to be able to get a loan or credit. The reason behind this is because it will help financial institutions to determine your creditworthiness. They will also see every loan that you made and the payment history that you have. Find out more about it by reading the information below.

Credit scores are calculated based on the proprietary algorithm. This will include the person's outstanding debts, payment history, and the length of the individual's credit history.

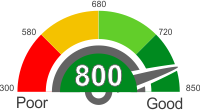

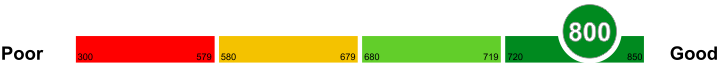

Credit scores can range from 300 to 850. The higher the individual's score, the lower the risk. People who have lower credit scores are considered high risk, which will make lending companies ask for more requirements.

About Fico scores

Fair Isaac Corporation is the one who established FICO, and it is one of the most commonly used credit scoring systems today.

According to FICO, 90% of the most reputable and respected lenders today are making decisions according to this kind of credit scoring system. Get to know more about Fico scores by reading the information below.

How are credit scores calculated?

The weight of each of the five categories are; 30% of amount owned, 10% is for the new credit, 15% accounts for the length of credit history, 10% is the credit mix and the last 35% accounts for the person's payment history.

The FICO score takes into consideration positive as well as negative aspects of the credit report. The percentage or the weight of any of the categories mentioned above may differ from a person to another depending upon the information available in the credit report.

The FICO score takes all of the information from your credit report. However, the banks or any other lending institution might look at your income, type of credit and employment history when you apply for a loan or mortgage.

Once a certain lender asks for a client's credit report, they can also ask for the Fico score. Other sources say that your Fico score will include 35% of your payment history, 30% of your credit utilization, and 15% as to how long have you been borrowing.

Explanation of credit score ranges

It is important to know the category that you fall into when it comes to credit score for you to be aware. The range of a credit score can go from 300 to 850. Always remember that the higher your score, the higher the chances of you to qualify for a loan. There will also be instances where a financing company is okay with 650 scores, while the other is fine with a 750 score. It will all depend on the lender itself.

A lender or a bank will check your credit score if you qualify for the application that you are requesting. Here are some of the credit score ranges that you should know.

Bad credit score

People with a credit score below 579 is known as high risks. Foreclosures, poor payment history, and bankruptcies are the reasons why people fall into this category.

Good credit score

A good credit score ranges from 680 to 719. People with this credit score can expect approvals and interest rates that are better.

Very Good

A very good credit score ranges from 720 to 799. People with this credit score is known to be small risks, and they often get loan amounts that are higher than usual.

Excellent

An excellent score ranges from 800 and above. Financial freedom is expected to people with this score.

What does it mean to have a credit score under 800

You can apply for a loan from the top-tier banks and enjoy the best offerings if you have had an excellent last 12 months regarding paying back loans and clearing credit payments on time.

At this moment, the further improvement of the credit score is not easy. You might not see significant jumps of credit score points of, for example, 50 credit score points in one or two weeks. However, you can push your luck and reach the safest assumed credit score bracket of 780 to 850.

Credit cards with a credit score under 800

If you have a credit score under 800 but over 750 then applying for a credit card will be easy.

People with a credit score under 800 but over 750 can easily avail of any credit card that they please. The reason behind this is because of the excellent credit score that they have. Here are some of the credit cards with great rewards for people like you.

PlayStation Card from Capital One

PlayStation Card from Capital One lets you earn 5,000 bonus points after purchasing in the first ninety days. For every USD 1 spent on any PlayStation Store, you can earn 10 points and three points for every USD 1 spent in Sony stores. It ha a zero annual fee.

Capital One Spark

Capital One Spark will let you earn 2 miles for every USD 1 spent on purchases. They have a one-time bonus of 50,000 miles after spending USD 4,500 on purchases. It has a zero annual fee and an APR of 17.24%.

Car loans with a credit score under 800

With a credit score of under 800 but over 750, companies will surely approve your application in no time.

People prefer buying their cars through a car loan because it makes the payment more affordable for them. But how do you get approved when applying for a loan, besides your credit score? Let's find out how below.

Lending Requirement

Lending companies have requirements that you need to meet. One of these is a monthly income of USD 1500 and a DTI of 45% or even less. If you do not meet the required income, you should at least have a good DTI score or be able to approve it.

Blank Check

When going to your chosen lending company, it would be best to bring a blank check. The reason behind this is because it helps in pre-approving your loan while talking about the guidelines with them. Once they have chosen the vehicle, you can provide them the blank check so they can finalize everything with the bank.

Mortgages with a credit score under 800

If you have a score that is below 800 but above 750, you have many loan offers and loan opportunities to look from. Most of the banks will be willing to lend you money for a home loan or mortgage. Your high score shows that you have the ability to pay with very little risk of defaulting on your payments.

You can also apply for any government loan scheme or offers for mortgage and new home loan. The advantage of going to the government is that the interest rates are low. Moreover, the terms and conditions of the loan and credit payment are flexible and more manageable.

Home Loans with a credit score under 800

With such a high score, most of the banks will find it less risky to lend you credit or loans. Because it shows, you have a history of paying your obligations on time and have an excellent credit history. The interest rates that will be offered to you by the banks will be lowest or better than most. You should apply for top banks and search for the best options available.

However, you may also want to apply for government home loans. Federal Housing Administration works for the government in America. You can get good offers for your home loan through the FHA approved lenders.

The option of getting credit from online sources may be available, but you need to check the interest rate and other costs associated with it.

Personal Loans with a credit score under 800

With an excellent credit score, you qualify for all personal loans available for those with a bad rating. Additionally, you get to enjoy flexible terms and the best credit rates. You are given single digit interest rates with some lenders as low as 5% and longer repayment periods. Getting a personal loan with a score over 750 is like a piece of cake.

Home equity loan

When push comes to shove, your home can be used as collateral for the personal loan. It is suitable for emergencies when you want the beat the bureaucracy involved in getting the loan from a bank. It is recommended to take a small amount to relieve your financial distress and then consider other options after repaying it.

Payday loan

If you have a steady source of income, you can get a personal loan that you can repay within a month. It is a favorable option where only a small amount is required within a short span. Repaying this loan might improve your credit score.

Unsecured bank loan

It is available to you if you have a clean credit history and a stable source of income. The monthly premiums are deducted directly from your salary. Long-term personal loans are offered with this option.

Things you can do to improve your credit score of 800

A score of 800 and above means that you have an excellent credit rating. It should not stop you from maintaining or improving it. You should not get too comfortable and take things for granted to a point where you forget your financial obligations. Doing this means that your credit rating my end up being damaged.

Increase your credit limit

This action improves you're the ratio of your credit utilization, which refers to the proportion of the credit limit you use versus what is available. Make a request for credit line increase, but if the lender intends to do a hard pull you can withdraw since it lowers your credit.

Tighten your privacy and security

Fraudsters may open credit accounts in your name without your name. Ensure you read your periodical reports to ensure they don't contain credit you haven't solicited. Don't share too much personal information on social media that fraudsters can take advantage of.

Clear your debts

Ensure that you owe no lender any outstanding amount. Even a $0.1 could have an impact on your credit score since it is still considered debt; worse still, it could be attracting interest. Lenders cannot trust you if you have long-running debts.